Page 236 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 236

218 Dubai & Co.

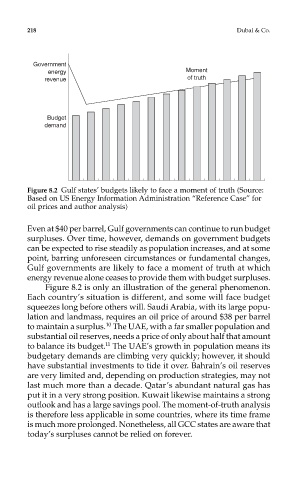

Figure 8.2 Gulf states’ budgets likely to face a moment of truth (Source:

Based on US Energy Information Administration “Reference Case” for

oil prices and author analysis)

Even at $40 per barrel, Gulf governments can continue to run budget

surpluses. Over time, however, demands on government budgets

can be expected to rise steadily as population increases, and at some

point, barring unforeseen circumstances or fundamental changes,

Gulf governments are likely to face a moment of truth at which

energy revenue alone ceases to provide them with budget surpluses.

Figure 8.2 is only an illustration of the general phenomenon.

Each country’s situation is different, and some will face budget

squeezes long before others will. Saudi Arabia, with its large popu-

lation and landmass, requires an oil price of around $38 per barrel

10

to maintain a surplus. The UAE, with a far smaller population and

substantial oil reserves, needs a price of only about half that amount

11

to balance its budget. The UAE’s growth in population means its

budgetary demands are climbing very quickly; however, it should

have substantial investments to tide it over. Bahrain’s oil reserves

are very limited and, depending on production strategies, may not

last much more than a decade. Qatar’s abundant natural gas has

put it in a very strong position. Kuwait likewise maintains a strong

outlook and has a large savings pool. The moment-of-truth analysis

is therefore less applicable in some countries, where its time frame

is much more prolonged. Nonetheless, all GCC states are aware that

today’s surpluses cannot be relied on forever.