Page 240 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 240

222 Dubai & Co.

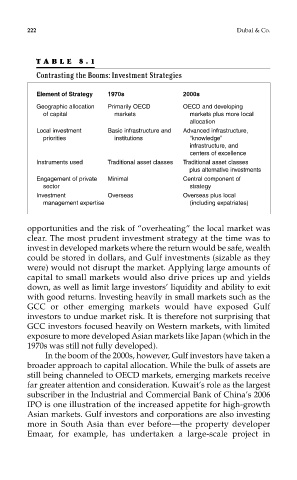

TABLE 8.1

Contrasting the Booms: Investment Strategies

Element of Strategy 1970s 2000s

Geographic allocation Primarily OECD OECD and developing

of capital markets markets plus more local

allocation

Local investment Basic infrastructure and Advanced infrastructure,

priorities institutions “knowledge”

infrastructure, and

centers of excellence

Instruments used Traditional asset classes Traditional asset classes

plus alternative investments

Engagement of private Minimal Central component of

sector strategy

Investment Overseas Overseas plus local

management expertise (including expatriates)

opportunities and the risk of “overheating” the local market was

clear. The most prudent investment strategy at the time was to

invest in developed markets where the return would be safe, wealth

could be stored in dollars, and Gulf investments (sizable as they

were) would not disrupt the market. Applying large amounts of

capital to small markets would also drive prices up and yields

down, as well as limit large investors’ liquidity and ability to exit

with good returns. Investing heavily in small markets such as the

GCC or other emerging markets would have exposed Gulf

investors to undue market risk. It is therefore not surprising that

GCC investors focused heavily on Western markets, with limited

exposure to more developed Asian markets like Japan (which in the

1970s was still not fully developed).

In the boom of the 2000s, however, Gulf investors have taken a

broader approach to capital allocation. While the bulk of assets are

still being channeled to OECD markets, emerging markets receive

far greater attention and consideration. Kuwait’s role as the largest

subscriber in the Industrial and Commercial Bank of China’s 2006

IPO is one illustration of the increased appetite for high-growth

Asian markets. Gulf investors and corporations are also investing

more in South Asia than ever before—the property developer

Emaar, for example, has undertaken a large-scale project in