Page 246 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 246

228 Dubai & Co.

long lines to register for shares. Many people quit their jobs entirely

when day trading became too lucrative. I recall a striking scene from

a visit to the Abu Dhabi stock exchange in 2005. The floor seemed to

be in a frenzy, with a buzz going all around, as is common to all

exchanges with human traders. Unlike the New York or Chicago

exchanges, however, most of the people on the floor were individual

investors—not professional brokers and dealers. When the

petrochemical company Yansab was listed in Saudi Arabia, almost

two-fifths of the Saudi national population—over 8 million people—

22

participated in the IPO. In the United States, by contrast, roughly

half of all households own any individual stocks at all, and no sin-

gle share would be universally owned by all of them. 23

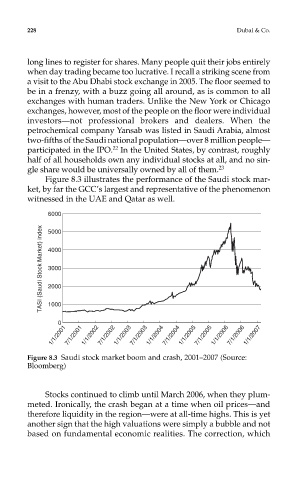

Figure 8.3 illustrates the performance of the Saudi stock mar-

ket, by far the GCC’s largest and representative of the phenomenon

witnessed in the UAE and Qatar as well.

Figure 8.3 Saudi stock market boom and crash, 2001–2007 (Source:

Bloomberg)

Stocks continued to climb until March 2006, when they plum-

meted. Ironically, the crash began at a time when oil prices—and

therefore liquidity in the region—were at all-time highs. This is yet

another sign that the high valuations were simply a bubble and not

based on fundamental economic realities. The correction, which