Page 248 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 248

230 Dubai & Co.

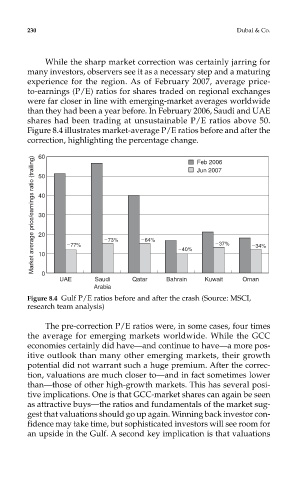

While the sharp market correction was certainly jarring for

many investors, observers see it as a necessary step and a maturing

experience for the region. As of February 2007, average price-

to-earnings (P/E) ratios for shares traded on regional exchanges

were far closer in line with emerging-market averages worldwide

than they had been a year before. In February 2006, Saudi and UAE

shares had been trading at unsustainable P/E ratios above 50.

Figure 8.4 illustrates market-average P/E ratios before and after the

correction, highlighting the percentage change.

Figure 8.4 Gulf P/E ratios before and after the crash (Source: MSCI,

research team analysis)

The pre-correction P/E ratios were, in some cases, four times

the average for emerging markets worldwide. While the GCC

economies certainly did have—and continue to have—a more pos-

itive outlook than many other emerging markets, their growth

potential did not warrant such a huge premium. After the correc-

tion, valuations are much closer to—and in fact sometimes lower

than—those of other high-growth markets. This has several posi-

tive implications. One is that GCC-market shares can again be seen

as attractive buys—the ratios and fundamentals of the market sug-

gest that valuations should go up again. Winning back investor con-

fidence may take time, but sophisticated investors will see room for

an upside in the Gulf. A second key implication is that valuations