Page 253 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 253

Capable Capital: The GCC as a Source of Capital 235

easier and more competitive in the UK. Even the United States has

now entered the market—with the Texas-based firm East Cameron

Gas Company issuing the first-ever American Sukuk in 2006. 32

These entities all saw value in taking the additional steps needed to

ensure Sharia compliance.

SOURCING CAPITAL: STRATEGIC

OR ACCIDENTAL

There is no shortage of examples of global companies for whom

GCC investors make up a meaningful segment of their investor

base. Apple and Citigroup, for example, count Alwaleed Bin

Talal as one of their largest shareholders. Investor relations

professionals at major listed companies may, in fact, be surprised at

the number of GCC investors who subscribe to their shares—

investors who can often be less vocal than large OECD mutual and

pension funds and therefore somewhat overlooked. Gulf investors

wishing to avoid media attention may also limit their stakes to

under the public disclosure threshold, which is 5 percent in the

United States, Japan, France, and Hong Kong, and 3 percent in

Britain and Germany. 33

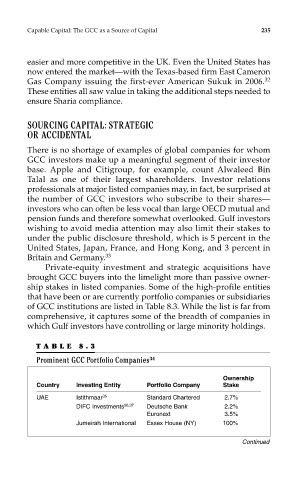

Private-equity investment and strategic acquisitions have

brought GCC buyers into the limelight more than passive owner-

ship stakes in listed companies. Some of the high-profile entities

that have been or are currently portfolio companies or subsidiaries

of GCC institutions are listed in Table 8.3. While the list is far from

comprehensive, it captures some of the breadth of companies in

which Gulf investors have controlling or large minority holdings.

TABLE 8.3

Prominent GCC Portfolio Companies 34

Ownership

Country Investing Entity Portfolio Company Stake

UAE Istithmaar 35 Standard Chartered 2.7%

DIFC Investments 36,37 Deutsche Bank 2.2%

Euronext 3.5%

Jumeirah International Essex House (NY) 100%

Continued