Page 257 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 257

Capable Capital: The GCC as a Source of Capital 239

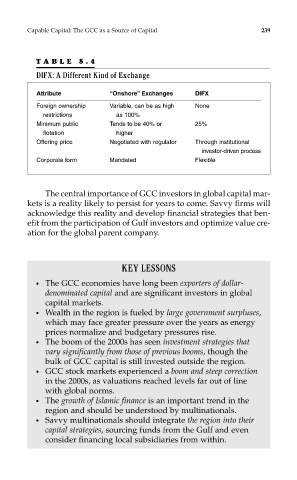

TABLE 8.4

DIFX: A Different Kind of Exchange

Attribute “Onshore” Exchanges DIFX

Foreign ownership Variable, can be as high None

restrictions as 100%

Minimum public Tends to be 40% or 25%

flotation higher

Offering price Negotiated with regulator Through institutional

investor-driven process

Corporate form Mandated Flexible

The central importance of GCC investors in global capital mar-

kets is a reality likely to persist for years to come. Savvy firms will

acknowledge this reality and develop financial strategies that ben-

efit from the participation of Gulf investors and optimize value cre-

ation for the global parent company.

KEY LESSONS

● The GCC economies have long been exporters of dollar-

denominated capital and are significant investors in global

capital markets.

● Wealth in the region is fueled by large government surpluses,

which may face greater pressure over the years as energy

prices normalize and budgetary pressures rise.

● The boom of the 2000s has seen investment strategies that

vary significantly from those of previous booms, though the

bulk of GCC capital is still invested outside the region.

● GCC stock markets experienced a boom and steep correction

in the 2000s, as valuations reached levels far out of line

with global norms.

● The growth of Islamic finance is an important trend in the

region and should be understood by multinationals.

● Savvy multinationals should integrate the region into their

capital strategies, sourcing funds from the Gulf and even

consider financing local subsidiaries from within.