Page 255 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 255

Capable Capital: The GCC as a Source of Capital 237

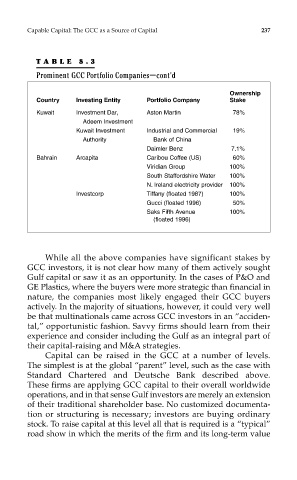

TABLE 8.3

Prominent GCC Portfolio Companies—cont’d

Ownership

Country Investing Entity Portfolio Company Stake

Kuwait Investment Dar, Aston Martin 78%

Adeem Investment

Kuwait Investment Industrial and Commercial 19%

Authority Bank of China

Daimler Benz 7.1%

Bahrain Arcapita Caribou Coffee (US) 60%

Viridian Group 100%

South Staffordshire Water 100%

N. Ireland electricity provider 100%

Investcorp Tiffany (floated 1987) 100%

Gucci (floated 1996) 50%

Saks Fifth Avenue 100%

(floated 1996)

While all the above companies have significant stakes by

GCC investors, it is not clear how many of them actively sought

Gulf capital or saw it as an opportunity. In the cases of P&O and

GE Plastics, where the buyers were more strategic than financial in

nature, the companies most likely engaged their GCC buyers

actively. In the majority of situations, however, it could very well

be that multinationals came across GCC investors in an “acciden-

tal,” opportunistic fashion. Savvy firms should learn from their

experience and consider including the Gulf as an integral part of

their capital-raising and M&A strategies.

Capital can be raised in the GCC at a number of levels.

The simplest is at the global “parent” level, such as the case with

Standard Chartered and Deutsche Bank described above.

These firms are applying GCC capital to their overall worldwide

operations, and in that sense Gulf investors are merely an extension

of their traditional shareholder base. No customized documenta-

tion or structuring is necessary; investors are buying ordinary

stock. To raise capital at this level all that is required is a “typical”

road show in which the merits of the firm and its long-term value