Page 247 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 247

Capable Capital: The GCC as a Source of Capital 229

continued throughout 2006, wiped out most of the gains made since

early 2005. As of June 2007, however, the market was up around 250

percent from its 2001 level. The investors most hurt by the correc-

tion were those who came in at the peak of the frenzy in 2005 and

2006—and these, unfortunately, tended to be the least sophisticated

and most vulnerable retail investors.

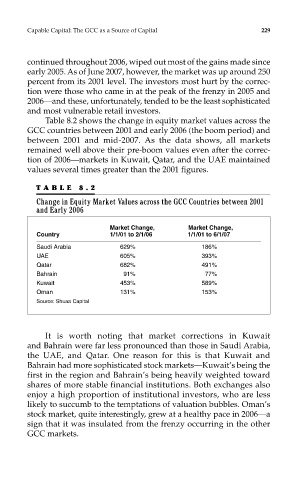

Table 8.2 shows the change in equity market values across the

GCC countries between 2001 and early 2006 (the boom period) and

between 2001 and mid-2007. As the data shows, all markets

remained well above their pre-boom values even after the correc-

tion of 2006—markets in Kuwait, Qatar, and the UAE maintained

values several times greater than the 2001 figures.

TABLE 8.2

Change in Equity Market Values across the GCC Countries between 2001

and Early 2006

Market Change, Market Change,

Country 1/1/01 to 2/1/06 1/1/01 to 6/1/07

Saudi Arabia 629% 186%

UAE 605% 393%

Qatar 682% 491%

Bahrain 91% 77%

Kuwait 453% 589%

Oman 131% 153%

Source: Shuaa Capital

It is worth noting that market corrections in Kuwait

and Bahrain were far less pronounced than those in Saudi Arabia,

the UAE, and Qatar. One reason for this is that Kuwait and

Bahrain had more sophisticated stock markets—Kuwait’s being the

first in the region and Bahrain’s being heavily weighted toward

shares of more stable financial institutions. Both exchanges also

enjoy a high proportion of institutional investors, who are less

likely to succumb to the temptations of valuation bubbles. Oman’s

stock market, quite interestingly, grew at a healthy pace in 2006—a

sign that it was insulated from the frenzy occurring in the other

GCC markets.