Page 294 - Essentials of Payroll: Management and Accounting

P. 294

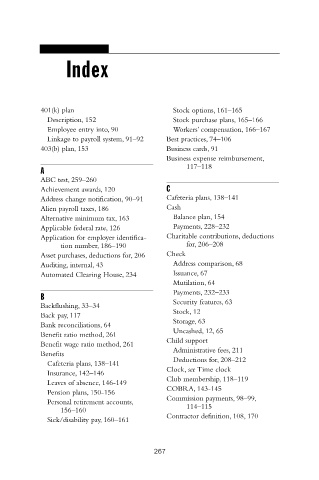

Index

401(k) plan Stock options, 161–165

Description, 152 Stock purchase plans, 165–166

Employee entry into, 90 Workers’ compensation, 166–167

Linkage to payroll system, 91–92 Best practices, 74–106

403(b) plan, 153 Business cards, 91

Business expense reimbursement,

117–118

A

ABC test, 259–260

Achievement awards, 120 C

Address change notification, 90–91 Cafeteria plans, 138–141

Alien payroll taxes, 186 Cash

Alternative minimum tax, 163 Balance plan, 154

Applicable federal rate, 126 Payments, 228–232

Application for employer identifica- Charitable contributions, deductions

tion number, 186–190 for, 206–208

Asset purchases, deductions for, 206 Check

Auditing, internal, 43 Address comparison, 68

Automated Clearing House, 234 Issuance, 67

Mutilation, 64

Payments, 232–233

B

Backflushing, 33–34 Security features, 63

Stock, 12

Back pay, 117

Storage, 63

Bank reconciliations, 64

Uncashed, 12, 65

Benefit ratio method, 261

Child support

Benefit wage ratio method, 261

Administrative fees, 211

Benefits

Deductions for, 208–212

Cafeteria plans, 138–141

Clock, see Time clock

Insurance, 142–146

Club membership, 118–119

Leaves of absence, 146-149

COBRA, 143-145

Pension plans, 150-156

Commission payments, 98–99,

Personal retirement accounts,

156–160 114–115

Contractor definition, 108, 170

Sick/disability pay, 160–161

267