Page 290 - Essentials of Payroll: Management and Accounting

P. 290

Unemployment Insurance

make the decision to contribute additional funds within 30 days of the

date when a state mails its notice of contribution rates to the company.

The decision to pay additional funds to the state should be based on a

cost-benefit analysis of the amount of funding required to reduce the

contribution rate versus the reduced amount of required contributions

that will be gained in the next calendar year by doing so.

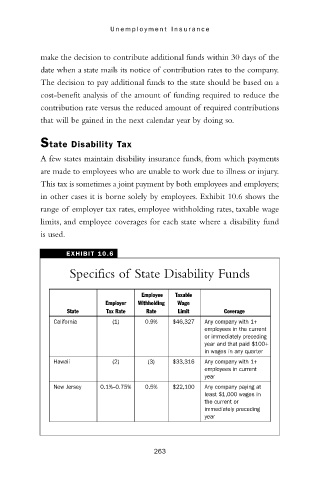

State Disability Tax

A few states maintain disability insurance funds, from which payments

are made to employees who are unable to work due to illness or injury.

This tax is sometimes a joint payment by both employees and employers;

in other cases it is borne solely by employees. Exhibit 10.6 shows the

range of employer tax rates, employee withholding rates, taxable wage

limits, and employee coverages for each state where a disability fund

is used.

EXHIBIT 10.6

Specifics of State Disability Funds

Employee Taxable

Employer Withholding Wage

State Tax Rate Rate Limit Coverage

California (1) 0.9% $46,327 Any company with 1+

employees in the current

or immediately preceding

year and that paid $100+

in wages in any quarter

Hawaii (2) (3) $33,316 Any company with 1+

employees in current

year

New Jersey 0.1%–0.75% 0.5% $22,100 Any company paying at

least $1,000 wages in

the current or

immediately preceding

year

263