Page 285 - Essentials of Payroll: Management and Accounting

P. 285

ESSENTIALS of Payr oll: Management and Accounting

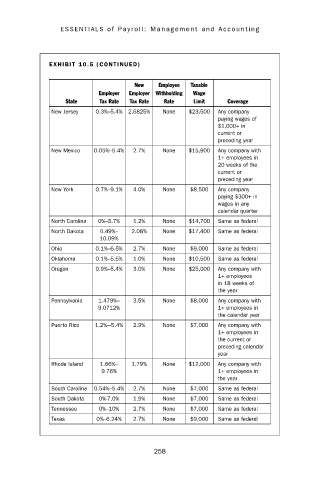

EXHIBIT 10.5 (CONTINUED)

New Employee Taxable

Employer Employer Withholding Wage

State Tax Rate Tax Rate Rate Limit Coverage

New Jersey 0.3%–5.4% 2.6825% None $23,500 Any company

paying wages of

$1,000+ in

current or

preceding year

New Mexico 0.05%–5.4% 2.7% None $15,900 Any company with

1+ employees in

20 weeks of the

current or

preceding year

New York 0.7%–9.1% 4.0% None $8,500 Any company

paying $300+ in

wages in any

calendar quarter

North Carolina 0%–5.7% 1.2% None $14,700 Same as federal

North Dakota 0.49%– 2.08% None $17,400 Same as federal

10.09%

Ohio 0.1%–6.5% 2.7% None $9,000 Same as federal

Oklahoma 0.1%–5.5% 1.0% None $10,500 Same as federal

Oregon 0.9%–5.4% 3.0% None $25,000 Any company with

1+ employees

in 18 weeks of

the year

Pennsylvania 1.479%– 3.5% None $8,000 Any company with

9.0712% 1+ employees in

the calendar year

Puerto Rico 1.2%-–5.4% 2.9% None $7,000 Any company with

1+ employees in

the current or

preceding calendar

year

Rhode Island 1.66%– 1.79% None $12,000 Any company with

9.76% 1+ employees in

the year

South Carolina 0.54%–5.4% 2.7% None $7,000 Same as federal

South Dakota 0%-7.0% 1.9% None $7,000 Same as federal

Tennessee 0%–10% 2.7% None $7,000 Same as federal

Texas 0%–6.24% 2.7% None $9,000 Same as federal

258