Page 284 - Essentials of Payroll: Management and Accounting

P. 284

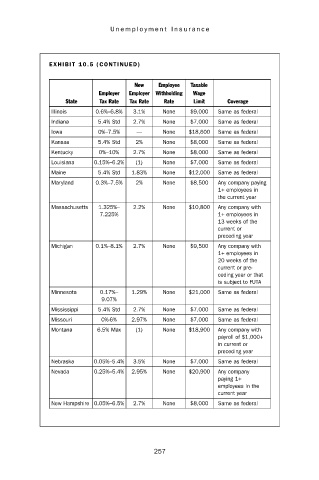

Unemployment Insurance

EXHIBIT 10.5 (CONTINUED)

New Employee Taxable

Employer Employer Withholding Wage

State Tax Rate Tax Rate Rate Limit Coverage

Illinois 0.6%–6.8% 3.1% None $9,000 Same as federal

Indiana 5.4% Std 2.7% None $7,000 Same as federal

Iowa 0%–7.5% — None $18,600 Same as federal

Kansas 5.4% Std 2% None $8,000 Same as federal

Kentucky 0%–10% 2.7% None $8,000 Same as federal

Louisiana 0.15%–6.2% (1) None $7,000 Same as federal

Maine 5.4% Std 1.83% None $12,000 Same as federal

Maryland 0.3%–7.5% 2% None $8,500 Any company paying

1+ employees in

the current year

Massachusetts 1.325%– 2.2% None $10,800 Any company with

7.225% 1+ employees in

13 weeks of the

current or

preceding year

Michigan 0.1%–8.1% 2.7% None $9,500 Any company with

1+ employees in

20 weeks of the

current or pre-

ceding year or that

is subject to FUTA

Minnesota 0.17%– 1.29% None $21,000 Same as federal

9.07%

Mississippi 5.4% Std 2.7% None $7,000 Same as federal

Missouri 0%-6% 2.97% None $7,000 Same as federal

Montana 6.5% Max (1) None $18,900 Any company with

payroll of $1,000+

in current or

preceding year

Nebraska 0.05%–5.4% 3.5% None $7,000 Same as federal

Nevada 0.25%–5.4% 2.95% None $20,900 Any company

paying 1+

employees in the

current year

New Hampshire 0.05%–6.5% 2.7% None $8,000 Same as federal

257