Page 286 - Essentials of Payroll: Management and Accounting

P. 286

Unemployment Insurance

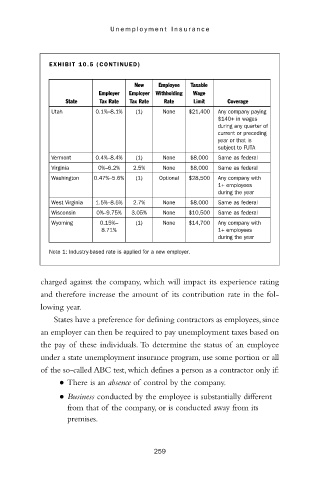

EXHIBIT 10.5 (CONTINUED)

New Employee Taxable

Employer Employer Withholding Wage

State Tax Rate Tax Rate Rate Limit Coverage

Utah 0.1%–8.1% (1) None $21,400 Any company paying

$140+ in wages

during any quarter of

current or preceding

year or that is

subject to FUTA

Vermont 0.4%–8.4% (1) None $8,000 Same as federal

Virginia 0%–6.2% 2.5% None $8,000 Same as federal

Washington 0.47%–5.6% (1) Optional $28,500 Any company with

1+ employees

during the year

West Virginia 1.5%–8.5% 2.7% None $8,000 Same as federal

Wisconsin 0%–9.75% 3.05% None $10,500 Same as federal

Wyoming 0.15%– (1) None $14,700 Any company with

8.71% 1+ employees

during the year

Note 1: Industry-based rate is applied for a new employer.

charged against the company, which will impact its experience rating

and therefore increase the amount of its contribution rate in the fol-

lowing year.

States have a preference for defining contractors as employees, since

an employer can then be required to pay unemployment taxes based on

the pay of these individuals. To determine the status of an employee

under a state unemployment insurance program, use some portion or all

of the so-called ABC test, which defines a person as a contractor only if:

• There is an absence of control by the company.

• Business conducted by the employee is substantially different

from that of the company, or is conducted away from its

premises.

259