Page 283 - Essentials of Payroll: Management and Accounting

P. 283

ESSENTIALS of Payr oll: Management and Accounting

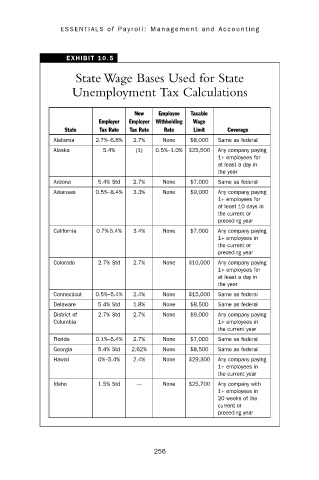

EXHIBIT 10.5

State Wage Bases Used for State

Unemployment Tax Calculations

New Employee Taxable

Employer Employer Withholding Wage

State Tax Rate Tax Rate Rate Limit Coverage

Alabama 2.7%–6.8% 2.7% None $8,000 Same as federal

Alaska 5.4% (1) 0.5%–1.0% $25,500 Any company paying

1+ employees for

at least a day in

the year

Arizona 5.4% Std 2.7% None $7,000 Same as federal

Arkansas 0.5%–8.4% 3.3% None $9,000 Any company paying

1+ employees for

at least 10 days in

the current or

preceding year

California 0.7%-5.4% 3.4% None $7,000 Any company paying

1+ employees in

the current or

preceding year

Colorado 2.7% Std 2.7% None $10,000 Any company paying

1+ employees for

at least a day in

the year

Connecticut 0.5%–5.4% 2.4% None $15,000 Same as federal

Delaware 5.4% Std 1.8% None $8,500 Same as federal

District of 2.7% Std 2.7% None $9,000 Any company paying

Columbia 1+ employees in

the current year

Florida 0.1%–5.4% 2.7% None $7,000 Same as federal

Georgia 5.4% Std 2.62% None $8,500 Same as federal

Hawaii 0%–5.4% 2.4% None $29,300 Any company paying

1+ employees in

the current year

Idaho 1.5% Std — None $25,700 Any company with

1+ employees in

20 weeks of the

current or

preceding year

256