Page 36 - Essentials of Payroll: Management and Accounting

P. 36

Cr eating a Payr oll System

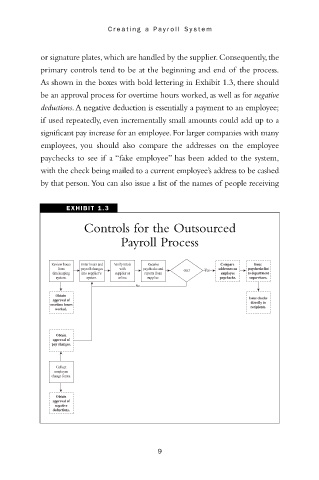

or signature plates,which are handled by the supplier.Consequently,the

primary controls tend to be at the beginning and end of the process.

As shown in the boxes with bold lettering in Exhibit 1.3, there should

be an approval process for overtime hours worked, as well as for negative

deductions.A negative deduction is essentially a payment to an employee;

if used repeatedly, even incrementally small amounts could add up to a

significant pay increase for an employee.For larger companies with many

employees, you should also compare the addresses on the employee

paychecks to see if a “fake employee” has been added to the system,

with the check being mailed to a current employee’s address to be cashed

by that person.You can also issue a list of the names of people receiving

EXHIBIT 1.3

Controls for the Outsourced

Payroll Process

Review hours Enter hours and Verify totals Receive Compare Issue

from payroll changes with paychecks and OK? Yes addresses on paychecks list

timekeeping into supplier’s supplier or reports from employee to department

system. system. online. supplier. paychecks. supervisors.

No

Obtain

approval of Issue checks

overtime hours directly to

worked. recipients.

Obtain

approval of

pay changes.

Collect

employee

change forms.

Obtain

approval of

negative

deductions.

9