Page 38 - Essentials of Payroll: Management and Accounting

P. 38

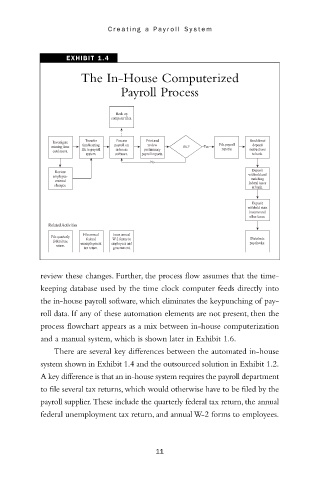

EXHIBIT 1.4 Cr eating a Payr oll System

The In-House Computerized

Payroll Process

Back up

computer files.

Transfer Process Print and Send direct

Investigate

missing time timekeeping payroll on review OK? Yes File payroll deposit

reports.

card scans. file to payroll in-house preliminary instructions

system. software. payroll reports. to bank.

No

Deposit

Review

employee- withheld and

matching

entered

changes. federal taxes

at bank.

Deposit

withheld state

income and

other taxes.

Related Activities

File annual Issue annual

File quarterly

federal W-2 forms to Distribute

federal tax

unemployment employees and paychecks.

return.

tax return. government.

review these changes. Further, the process flow assumes that the time-

keeping database used by the time clock computer feeds directly into

the in-house payroll software, which eliminates the keypunching of pay-

roll data. If any of these automation elements are not present, then the

process flowchart appears as a mix between in-house computerization

and a manual system, which is shown later in Exhibit 1.6.

There are several key differences between the automated in-house

system shown in Exhibit 1.4 and the outsourced solution in Exhibit 1.2.

A key difference is that an in-house system requires the payroll department

to file several tax returns, which would otherwise have to be filed by the

payroll supplier.These include the quarterly federal tax return, the annual

federal unemployment tax return, and annual W-2 forms to employees.

11