Page 42 - Essentials of Payroll: Management and Accounting

P. 42

Cr eating a Payr oll System

The flowchart does not mention the preparation of a direct deposit

database that can be forwarded to a bank, since it is most unlikely that

a company without means to calculate its payroll on a computer will be

able to create the direct deposit database.Also, the three types of reports

shown in the lower left corner of Exhibit 1.6 will require manual com-

pletion, which would not necessarily be the case if an in-house com-

puterized system were used, as such systems often have the capability to

produce these standard tax reports at the touch of a button.

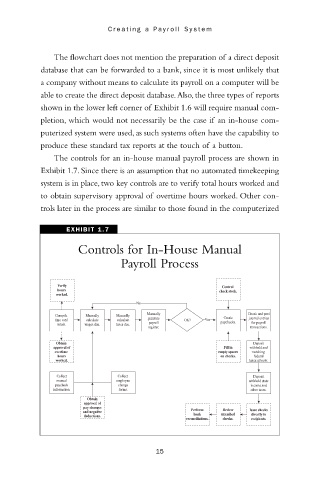

The controls for an in-house manual payroll process are shown in

Exhibit 1.7. Since there is an assumption that no automated timekeeping

system is in place, two key controls are to verify total hours worked and

to obtain supervisory approval of overtime hours worked. Other con-

trols later in the process are similar to those found in the computerized

EXHIBIT 1.7

Controls for In-House Manual

Payroll Process

Verify Control

hours check stock.

worked.

No

Manually Create and post

Compile Manually Manually

Create

time card calculate calculate generate OK? Yes paychecks. journal entries

for payroll

payroll

totals. wages due. taxes due.

register. transactions.

Obtain Deposit

approval of Fill in withheld and

overtime empty spaces matching

hours on checks. federal

worked. taxes at bank.

Collect Collect Deposit

manual employee withheld state

paycheck change income and

information. forms. other taxes.

Obtain

approval of

pay changes

Review

and negative Perform uncashed Issue checks

bank

directly to

deductions.

reconciliations. checks. recipients.

15