Page 41 - Essentials of Payroll: Management and Accounting

P. 41

ESSENTIALS of Payr oll: Management and Accounting

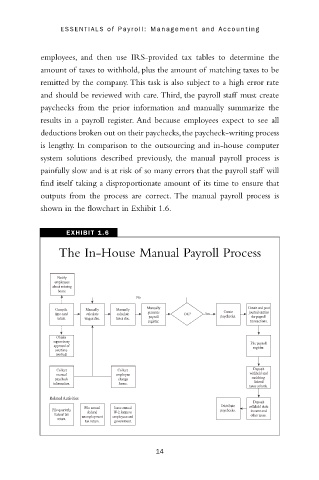

employees, and then use IRS-provided tax tables to determine the

amount of taxes to withhold, plus the amount of matching taxes to be

remitted by the company. This task is also subject to a high error rate

and should be reviewed with care. Third, the payroll staff must create

paychecks from the prior information and manually summarize the

results in a payroll register. And because employees expect to see all

deductions broken out on their paychecks,the paycheck-writing process

is lengthy. In comparison to the outsourcing and in-house computer

system solutions described previously, the manual payroll process is

painfully slow and is at risk of so many errors that the payroll staff will

find itself taking a disproportionate amount of its time to ensure that

outputs from the process are correct. The manual payroll process is

shown in the flowchart in Exhibit 1.6.

EXHIBIT 1.6

The In-House Manual Payroll Process

Notify

employees

about missing

hours.

No

Manually Create and post

Compile Manually Manually

Create

time card calculate calculate generate OK? Yes paychecks. journal entries

payroll

for payroll

totals. wages due. taxes due.

register. transactions.

Obtain

supervisory File payroll

approval of register.

overtime

worked.

Collect Collect Deposit

withheld and

manual employee

paycheck change matching

information. forms. federal

taxes at bank.

Related Activities

Deposit

Distribute

File annual Issue annual withheld state

File quarterly federal W-2 forms to paychecks. income and

federal tax unemployment employees and other taxes.

return.

tax return. government.

14