Page 219 - Finance for Non-Financial Managers

P. 219

Siciliano12.qxd 2/8/2003 7:35 AM Page 200

Finance for Non-Financial Managers

200

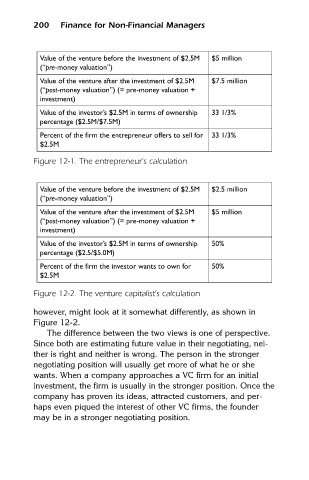

Value of the venture before the investment of $2.5M

(“pre-money valuation”)

Value of the venture after the investment of $2.5M $5 million

$7.5 million

(“post-money valuation”) (= pre-money valuation +

investment)

Value of the investor’s $2.5M in terms of ownership 33 1/3%

percentage ($2.5M/$7.5M)

Percent of the firm the entrepreneur offers to sell for 33 1/3%

$2.5M

Figure 12-1. The entrepreneur’s calculation

Value of the venture before the investment of $2.5M $2.5 million

(“pre-money valuation”)

Value of the venture after the investment of $2.5M $5 million

(“post-money valuation”) (= pre-money valuation +

investment)

Value of the investor’s $2.5M in terms of ownership 50%

percentage ($2.5/$5.0M)

Percent of the firm the investor wants to own for 50%

$2.5M

Figure 12-2. The venture capitalist’s calculation

however, might look at it somewhat differently, as shown in

Figure 12-2.

The difference between the two views is one of perspective.

Since both are estimating future value in their negotiating, nei-

ther is right and neither is wrong. The person in the stronger

negotiating position will usually get more of what he or she

wants. When a company approaches a VC firm for an initial

investment, the firm is usually in the stronger position. Once the

company has proven its ideas, attracted customers, and per-

haps even piqued the interest of other VC firms, the founder

may be in a stronger negotiating position.