Page 88 - Finance for Non-Financial Managers

P. 88

Siciliano05.qxd 2/8/2003 6:39 AM Page 69

Profit vs. Cash Flow

In the final analysis, then, when a company closes its doors,

the only real financial measure of its success is the difference

between the amount of cash it started with and the amount it 69

ended with, after considering cash distributed to its owners over

the life of the business. However, during the life of a company,

we can’t very well judge how much cash it would produce if it

closed and liquidated, so we must measure success in terms of

how it succeeds in conducting activities that will ultimately pro-

duce cash, usually measured in terms of profits and other finan-

cial factors included in the monthly reports we discussed in

Chapters 3 and 4.

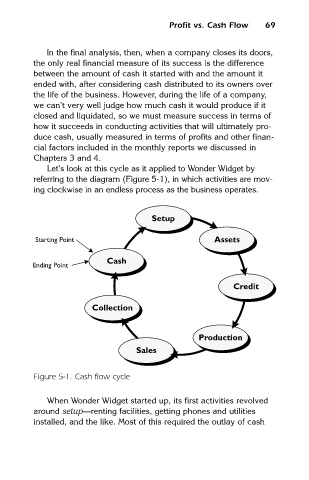

Let’s look at this cycle as it applied to Wonder Widget by

referring to the diagram (Figure 5-1), in which activities are mov-

ing clockwise in an endless process as the business operates.

Setup

Starting Point Assets

Cash

Ending Point

Credit

Collection

Production

Sales

Figure 5-1. Cash flow cycle

When Wonder Widget started up, its first activities revolved

around setup—renting facilities, getting phones and utilities

installed, and the like. Most of this required the outlay of cash