Page 186 - Green Building Through Integrated Design

P. 186

162 INTEGRATED PROJECT MANAGEMENT—COST/BENEFIT ANALYSIS OF GREEN BUILDINGS

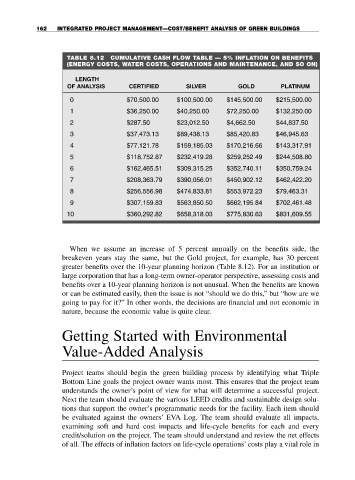

TABLE 8.12 CUMULATIVE CASH FLOW TABLE — 5% INFLATION ON BENEFITS

(ENERGY COSTS, WATER COSTS, OPERATIONS AND MAINTENANCE, AND SO ON)

LENGTH

OF ANALYSIS CERTIFIED SILVER GOLD PLATINUM

0 $70,500.00 $100,500.00 $145,500.00 $215,500.00

1 $36,250.00 $40,250.00 $72,250.00 $132,250.00

2 $287.50 $23,012.50 $4,662.50 $44,837.50

3 $37,473.13 $89,438.13 $85,420.83 $46,945.63

4 $77,121.78 $159,185.03 $170,216.66 $143,317.91

5 $118,752.87 $232,419.28 $259,252.49 $244,508.80

6 $162,465.51 $309,315.25 $352,740.11 $350,759.24

7 $208,363.79 $390,056.01 $450,902.12 $462,422.20

8 $256,556.98 $474,833.81 $553,972.23 $79,463.31

9 $307,159.83 $563,850.50 $662,195.84 $702,461.48

10 $360,292.82 $658,318.03 $775,830.63 $831,609.55

When we assume an increase of 5 percent annually on the benefits side, the

breakeven years stay the same, but the Gold project, for example, has 30 percent

greater benefits over the 10-year planning horizon (Table 8.12). For an institution or

large corporation that has a long-term owner-operator perspective, assessing costs and

benefits over a 10-year planning horizon is not unusual. When the benefits are known

or can be estimated easily, then the issue is not “should we do this,” but “how are we

going to pay for it?” In other words, the decisions are financial and not economic in

nature, because the economic value is quite clear.

Getting Started with Environmental

Value-Added Analysis

Project teams should begin the green building process by identifying what Triple

Bottom Line goals the project owner wants most. This ensures that the project team

understands the owner’s point of view for what will determine a successful project.

Next the team should evaluate the various LEED credits and sustainable design solu-

tions that support the owner’s programmatic needs for the facility. Each item should

be evaluated against the owners’ EVA Log. The team should evaluate all impacts,

examining soft and hard cost impacts and life-cycle benefits for each and every

credit/solution on the project. The team should understand and review the net effects

of all. The effects of inflation factors on life-cycle operations’ costs play a vital role in