Page 102 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 102

86 PART I Background and Context

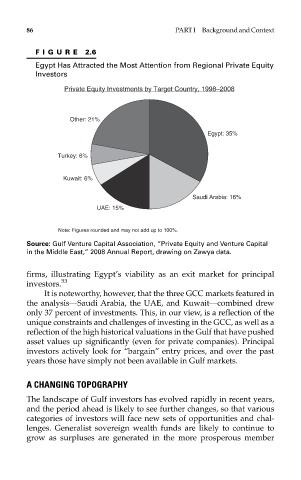

FIGURE 2.6

Egypt Has Attracted the Most Attention from Regional Private Equity

Investors

Private Equity Investments by Target Country, 1998–2008

Other: 21%

Egypt: 35%

Turkey: 6%

Kuwait: 6%

Saudi Arabia: 16%

UAE: 15%

Note: Figures rounded and may not add up to 100%.

Source: Gulf Venture Capital Association, “Private Equity and Venture Capital

in the Middle East,” 2008 Annual Report, drawing on Zawya data.

firms, illustrating Egypt’s viability as an exit market for principal

investors. 53

It is noteworthy, however, that the three GCC markets featured in

the analysis—Saudi Arabia, the UAE, and Kuwait—combined drew

only 37 percent of investments. This, in our view, is a reflection of the

unique constraints and challenges of investing in the GCC, as well as a

reflection of the high historical valuations in the Gulf that have pushed

asset values up significantly (even for private companies). Principal

investors actively look for “bargain” entry prices, and over the past

years those have simply not been available in Gulf markets.

A CHANGING TOPOGRAPHY

The landscape of Gulf investors has evolved rapidly in recent years,

and the period ahead is likely to see further changes, so that various

categories of investors will face new sets of opportunities and chal-

lenges. Generalist sovereign wealth funds are likely to continue to

grow as surpluses are generated in the more prosperous member