Page 98 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 98

82 PART I Background and Context

Private Equity Shops Are Dynamic and Growing

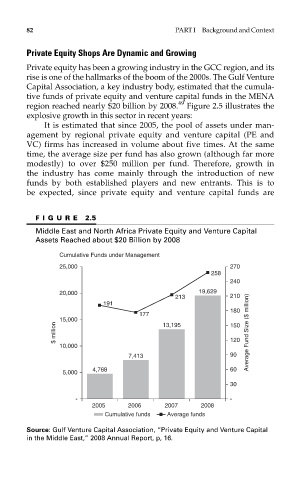

Private equity has been a growing industry in the GCC region, and its

rise is one of the hallmarks of the boom of the 2000s. The Gulf Venture

Capital Association, a key industry body, estimated that the cumula-

tive funds of private equity and venture capital funds in the MENA

region reached nearly $20 billion by 2008. 49 Figure 2.5 illustrates the

explosive growth in this sector in recent years:

It is estimated that since 2005, the pool of assets under man-

agement by regional private equity and venture capital (PE and

VC) firms has increased in volume about five times. At the same

time, the average size per fund has also grown (although far more

modestly) to over $250 million per fund. Therefore, growth in

the industry has come mainly through the introduction of new

funds by both established players and new entrants. This is to

be expected, since private equity and venture capital funds are

FIGURE 2.5

Middle East and North Africa Private Equity and Venture Capital

Assets Reached about $20 Billion by 2008

Cumulative Funds under Management

25,000 270

258

240

20,000 19,629

213 210

191

180

177

15,000 13,195 150

$ million Average Fund Size ($ million)

10,000 120

7,413 90

4,768 60

5,000

30

- -

2005 2006 2007 2008

Cumulative funds Average funds

Source: Gulf Venture Capital Association, “Private Equity and Venture Capital

in the Middle East,” 2008 Annual Report, p, 16.