Page 99 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 99

CHAPTER 2 Entrusted Stewards 83

customarily closed-ended, and therefore new investments are chan-

neled to new funds.

Regional PE and VC firms have shown remarkable success in

some of their investments—even in the turbulent year 2008.

According to the same association report (citing data from the intelli-

gence firm Zawya), a number of leading PE firms exited investments

in 2008 with internal rates of return (IRRs) well above their stated tar-

50

gets. For example:

■ Abraaj Capital’s Buyout Fund II generated a reported

annualized IRR of 52 percent on its investment in National

Air Services (NAS) airlines—a remarkable feat considering

the large size of the original investment ($177 million).

■ Unicorn’s Global Private Equity Fund I (a fully Islamic fund)

achieved a reported annualized IRR of 98 percent on its

investment in the construction firm Ormix.

■ SHUAA Partners Fund I, another pioneer in the region,

exited its investment in the retailer Damas Jewelry for

$70 million, having entered at less than half that value

($33 million) in 2005. The precise IRR is unknown, since the

detailed capital structure of the transaction has not been

made public.

PE and VC shops in the region operate with a unique set of oppor-

tunities and constraints. A number of these are outlined in Table 2.10.

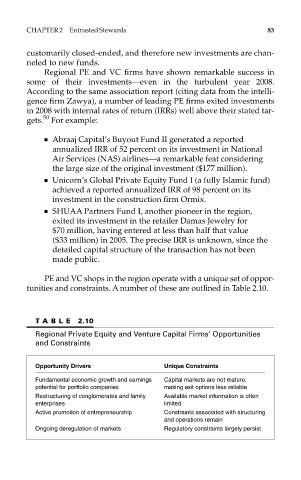

T ABLE 2.10

Regional Private Equity and Venture Capital Firms’ Opportunities

and Constraints

Opportunity Drivers Unique Constraints

Fundamental economic growth and earnings Capital markets are not mature,

potential for portfolio companies making exit options less reliable

Restructuring of conglomerates and family Available market information is often

enterprises limited

Active promotion of entrepreneurship Constraints associated with structuring

and operations remain

Ongoing deregulation of markets Regulatory constraints largely persist