Page 68 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 68

52

T

houses

vehicles

Category

ABLE

ment investment

eign wealth funds

Private institutions

Private investment

“Generalist” sover-

“Specialist” govern-

2.1

ment

wealth

wealth

investors

third-party

Objectives

grow private

Preserve and

Preserve and

grow national

Grow national

cial returns for

wealth through

strategic invest-

Maximize finan-

billion

billion

above

$10 billion;

Typical Size

$50 billion and

Typically below

$10 billion–$80

growing rapidly

ically below $10

Vary widely; typ-

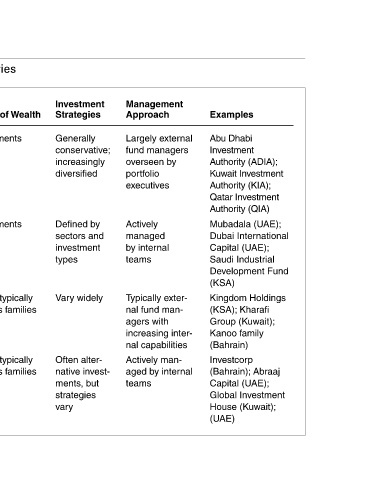

Gulf Institutional Investors Fit into Four Broad Categories

Governments

Governments

Private; typically

Private; typically

business families

business families

Source of Wealth

vary

types

Generally

strategies

diversified

ments, but

Defined by

Strategies

investment

Often alter-

Vary widely

Investment

sectors and

increasingly

native invest-

conservative;

teams

teams

Actively

portfolio

managed

by internal

agers with

executives

Approach

overseen by

Actively man-

Management

nal fund man-

nal capabilities

Typically exter-

fund managers

increasing inter-

aged by internal

Largely external

(UAE)

(KSA)

(Bahrain)

Abu Dhabi

Examples

Investcorp

Investment

Kanoo family

Capital (UAE);

(KSA); Kharafi

Authority (QIA)

Capital (UAE);

Authority (KIA);

Saudi Industrial

Group (Kuwait);

House (Kuwait);

Authority (ADIA);

Qatar Investment

(Bahrain); Abraaj

Mubadala (UAE);

Kuwait Investment

Global Investment

Kingdom Holdings

Development Fund

Dubai International