Page 69 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 69

CHAPTER 2 Entrusted Stewards 53

“GENERALIST” SOVEREIGN WEALTH FUNDS:

UNDERSTATED STEWARDS

The generalist sovereign wealth funds (SWFs) of the Gulf are the

region’s most prominent investors and, in many ways, its most

important. In the global SWF sector, Gulf institutions have been pio-

neers and today are leading players. According to estimates by the

Sovereign Wealth Fund Institute, Gulf institutions hold 41 percent of

global SWF assets, and three GCC sovereign funds are among the

world’s top seven SWFs by asset size (see Table 2.2).

Combined, the generalist SWFs listed in Table 2.2 are believed to

hold about $1.6 trillion in assets—two-fifths of the estimated global

total SWF asset base of $4 trillion. Remarkably, the Kuwait Investment

Authority (KIA) was established in 1953—more than 55 years ago and

far before the birth of most Kuwaitis alive today. The SWFs of the UAE

and Oman were founded in the wake of the oil booms of the 1970s,

whereas those of Qatar and Bahrain were formed in the boom of the

2000s. Saudi Arabia’s “SWF”—which is, in fact, an amalgamation of

preexisting holdings—was formalized in 1990, but its constituent parts

can be traced back further.

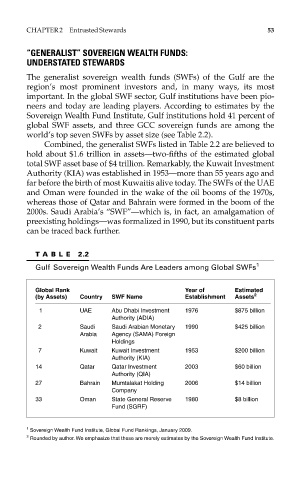

T ABLE 2.2

Gulf Sovereign Wealth Funds Are Leaders among Global SWFs 1

Global Rank Year of Estimated

(by Assets) Country SWF Name Establishment Assets 2

1 UAE Abu Dhabi Investment 1976 $875 billion

Authority (ADIA)

2 Saudi Saudi Arabian Monetary 1990 $425 billion

Arabia Agency (SAMA) Foreign

Holdings

7 Kuwait Kuwait Investment 1953 $200 billion

Authority (KIA)

14 Qatar Qatar Investment 2003 $60 billion

Authority (QIA)

27 Bahrain Mumtalakat Holding 2006 $14 billion

Company

33 Oman State General Reserve 1980 $8 billion

Fund (SGRF)

1

Sovereign Wealth Fund Institute, Global Fund Rankings, January 2009.

2

Rounded by author. We emphasize that these are merely estimates by the Sovereign Wealth Fund Institute.