Page 73 - Aamir Rehman Gulf Capital and Islamic Finance The Rise of the New Global Players

P. 73

CHAPTER 2 Entrusted Stewards 57

amount with which they are entrusted. The principal is touched only

in the event of a budget deficit and an urgent need for liquidity.

A final key contrast relates to the management model.

Investment funds generally rely on the capabilities of an internal

investment team—in fact, their very selling point to investors is often

the specific strengths of a defined set of managers. National trusts, on

the other hand, are run by portfolio executives who, in turn, engage a

large number of external fund managers. The people who run

national trusts have investment expertise, but their stewardship qual-

ities are more important than their hands-on technical expertise.

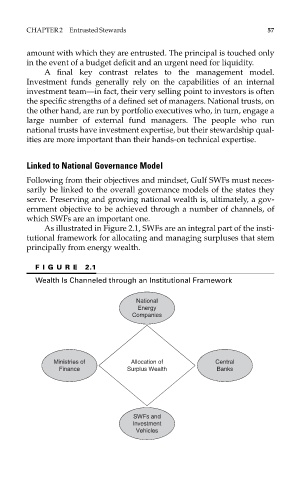

Linked to National Governance Model

Following from their objectives and mindset, Gulf SWFs must neces-

sarily be linked to the overall governance models of the states they

serve. Preserving and growing national wealth is, ultimately, a gov-

ernment objective to be achieved through a number of channels, of

which SWFs are an important one.

As illustrated in Figure 2.1, SWFs are an integral part of the insti-

tutional framework for allocating and managing surpluses that stem

principally from energy wealth.

FIGURE 2.1

Wealth Is Channeled through an Institutional Framework

National

Energy

Companies

Ministries of Allocation of Central

Finance Surplus Wealth Banks

SWFs and

Investment

Vehicles