Page 212 - Hydrocarbon Exploration and Production Second Edition

P. 212

Field Appraisal 199

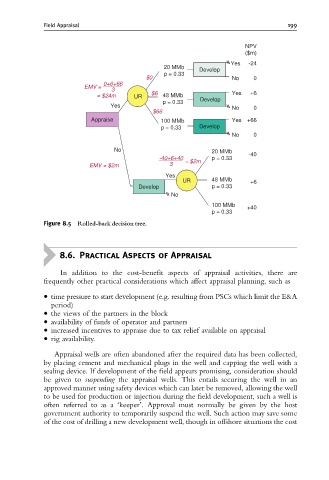

NPV

($m)

Yes -24

20 MMb

Develop

p = 0.33

$0 No 0

0+6+66

EMV =

3

= $24m UR $6 48 MMb Yes +6

p = 0.33 Develop

Yes No 0

$66

Appraise 100 MMb Yes +66

p = 0.33 Develop

No 0

No 20 MMb

-40

-40+6+40 = $2m p = 0.33

EMV = $2m 3

Yes

UR 48 MMb +6

Develop p = 0.33

No

100 MMb +40

p = 0.33

Figure 8.5 Rolled-back decision tree.

8.6. Practical Aspects of Appraisal

In addition to the cost-benefit aspects of appraisal activities, there are

frequently other practical considerations which affect appraisal planning, such as

time pressure to start development (e.g. resulting from PSCs which limit the E&A

period)

the views of the partners in the block

availability of funds of operator and partners

increased incentives to appraise due to tax relief available on appraisal

rig availability.

Appraisal wells are often abandoned after the required data has been collected,

by placing cement and mechanical plugs in the well and capping the well with a

sealing device. If development of the field appears promising, consideration should

be given to suspending the appraisal wells. This entails securing the well in an

approved manner using safety devices which can later be removed, allowing the well

to be used for production or injection during the field development, such a well is

often referred to as a ‘keeper’. Approval must normally be given by the host

government authority to temporarily suspend the well. Such action may save some

of the cost of drilling a new development well, though in offshore situations the cost