Page 351 - Hydrocarbon Exploration and Production Second Edition

P. 351

338 Basic Principles of Development Economics

These data must be collected from a number of different departments and bodies

(e.g. petroleum engineering, engineering, taxation and legal, host government) and

each data set carries with it a range of uncertainty. Data gathering and establishing

realistic ranges of uncertainty can be very time consuming.

The economic model for evaluation of investment (or divestment) opportunities is

normally constructed as a spreadsheet, using the techniques to be introduced in this

section. Specialised software packages are available for the analysis, but are generally

costly due to the requirement for sufficient flexibility to model different fiscal

systems around the world. Petroleum economists often write bespoke spreadsheet-

based models, tailored to a particular fiscal system, but this in turn creates an issue of

consistency within an organisation.

The uncertainties in the model’s input data are handled by establishing a base case

(often using the ‘best guess’ values of the input variables) and then investigating the

impact of varying the values of key inputs in a sensitivity analysis.

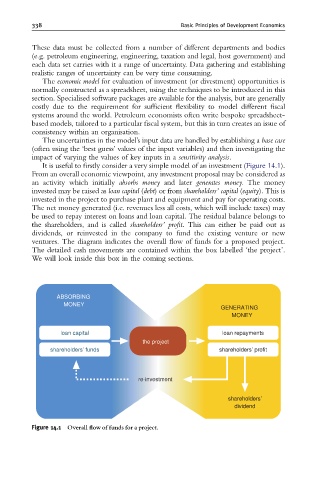

It is useful to firstly consider a very simple model of an investment (Figure 14.1).

From an overall economic viewpoint, any investment proposal may be considered as

an activity which initially absorbs money and later generates money. The money

invested may be raised as loan capital (debt)orfrom shareholders’ capital (equity). This is

invested in the project to purchase plant and equipment and pay for operating costs.

The net money generated (i.e. revenues less all costs, which will include taxes) may

be used to repay interest on loans and loan capital. The residual balance belongs to

the shareholders, and is called shareholders’ profit. This can either be paid out as

dividends, or reinvested in the company to fund the existing venture or new

ventures. The diagram indicates the overall flow of funds for a proposed project.

The detailed cash movements are contained within the box labelled ‘the project’.

We will look inside this box in the coming sections.

ABSORBING

MONEY

GENERATING

MONEY

loan capital loan repayments

the project

shareholders’ funds shareholders’ profit

re-investment

shareholders’

dividend

Figure 14.1 Overall £ow of funds for a project.