Page 23 - Introduction to Mineral Exploration

P. 23

6 C.J. MOON & A.M. EVANS

1200 16

12

Ore production (Mt) Metal production (Mt) 8 Cu Zn

800

400

4 Pb

0

1900 1920 1940 1960 1980 2000 0

1900 1920 1940 1960 1980 2000

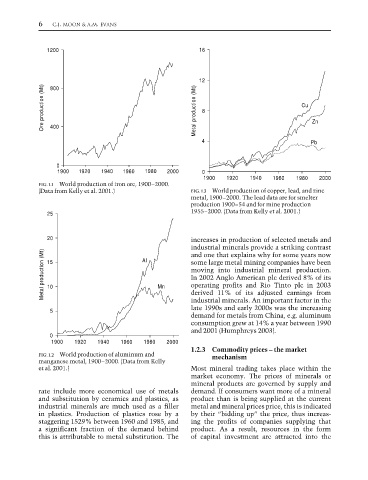

FIG. 1.1 World production of iron ore, 1900–2000.

(Data from Kelly et al. 2001.) FIG. 1.3 World production of copper, lead, and zinc

metal, 1900–2000. The lead data are for smelter

production 1900–54 and for mine production

1955–2000. (Data from Kelly et al. 2001.)

25

20 increases in production of selected metals and

industrial minerals provide a striking contrast

Metal production (Mt) 15 Mn some large metal mining companies have been

and one that explains why for some years now

Al

moving into industrial mineral production.

In 2002 Anglo American plc derived 8% of its

operating profits and Rio Tinto plc in 2003

10

derived 11% of its adjusted earnings from

industrial minerals. An important factor in the

late 1990s and early 2000s was the increasing

5

demand for metals from China, e.g. aluminum

consumption grew at 14% a year between 1990

and 2001 (Humphreys 2003).

0

1900 1920 1940 1960 1980 2000

1.2.3 Commodity prices – the market

FIG. 1.2 World production of aluminum and mechanism

manganese metal, 1900–2000. (Data from Kelly

et al. 2001.) Most mineral trading takes place within the

market economy. The prices of minerals or

mineral products are governed by supply and

rate include more economical use of metals demand. If consumers want more of a mineral

and substitution by ceramics and plastics, as product than is being supplied at the current

industrial minerals are much used as a filler metal and mineral prices price, this is indicated

in plastics. Production of plastics rose by a by their “bidding up” the price, thus increas-

staggering 1529% between 1960 and 1985, and ing the profits of companies supplying that

a significant fraction of the demand behind product. As a result, resources in the form

this is attributable to metal substitution. The of capital investment are attracted into the