Page 34 - Introduction to Mineral Exploration

P. 34

1: ORE, MINERAL ECONOMICS, AND MINERAL EXPLORATION 17

6000 1600

Total PDAC

5000 Total MEG estimate 1400 Canada Old Series

Total MEG surveys

US$ million 3000 Expenditure (US$ million) 1200

4000

1000

2000

1000 800

600

0 400

1970 1975 1980 1985 1990 1995 2000 Australia Canada

200 New Series

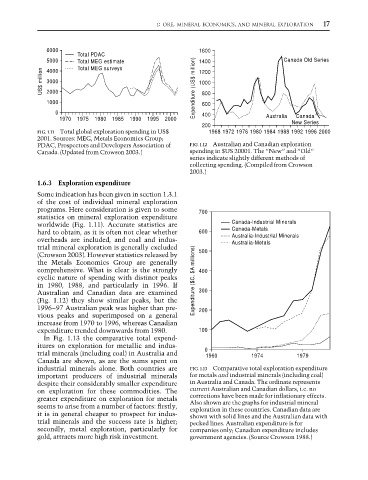

FIG. 1.11 Total global exploration spending in US$ 1968 1972 1976 1980 1984 1988 1992 1996 2000

2001. Sources: MEG, Metals Economics Group;

PDAC, Prospectors and Developers Association of FIG. 1.12 Australian and Canadian exploration

Canada. (Updated from Crowson 2003.) spending in $US 20001. The “New” and “Old”

series indicate slightly different methods of

collecting spending. (Compiled from Crowson

2003.)

1.6.3 Exploration expenditure

Some indication has been given in section 1.3.1

of the cost of individual mineral exploration

programs. Here consideration is given to some 700

statistics on mineral exploration expenditure

worldwide (Fig. 1.11). Accurate statistics are Canada-Industrial Minerals

hard to obtain, as it is often not clear whether 600 Canada-Metals

Australia-Industrial Minerals

overheads are included, and coal and indus- Australia-Metals

trial mineral exploration is generally excluded

(Crowson 2003). However statistics released by 500

the Metals Economics Group are generally

comprehensive. What is clear is the strongly 400

cyclic nature of spending with distinct peaks Expenditure ($C, $A millions)

in 1980, 1988, and particularly in 1996. If

Australian and Canadian data are examined 300

(Fig. 1.12) they show similar peaks, but the

1996–97 Australian peak was higher than pre- 200

vious peaks and superimposed on a general

increase from 1970 to 1996, whereas Canadian

expenditure trended downwards from 1980. 100

In Fig. 1.13 the comparative total expend-

itures on exploration for metallic and indus-

trial minerals (including coal) in Australia and 0 1960 1974 1979

Canada are shown, as are the sums spent on

industrial minerals alone. Both countries are FIG. 1.13 Comparative total exploration expenditure

important producers of industrial minerals for metals and industrial minerals (including coal)

despite their considerably smaller expenditure in Australia and Canada. The ordinate represents

on exploration for these commodities. The current Australian and Canadian dollars, i.e. no

greater expenditure on exploration for metals corrections have been made for inflationary effects.

seems to arise from a number of factors: firstly, Also shown are the graphs for industrial mineral

exploration in these countries. Canadian data are

it is in general cheaper to prospect for indus- shown with solid lines and the Australian data with

trial minerals and the success rate is higher; pecked lines. Australian expenditure is for

secondly, metal exploration, particularly for companies only; Canadian expenditure includes

gold, attracts more high risk investment. government agencies. (Source Crowson 1988.)