Page 72 - Introduction to Mineral Exploration

P. 72

4: RECONNAISSANCE EXPLORATION 55

President

Vice-President, Exploration Vice-President, Mining

Central Engineering

Mines Managers

Manager Manager Manager

Manager, Exploration Manager, Geophysics

Geological Staff Mines

Research Functions Geology

Geophysical Geophysical Geochemistry Geology Admin. Chief Special Chief Mine

Region Managers

Services Research Labs. Labs. Services Geologist Projects Geologist

Staff Project

Project Managers

Geologists Geologists

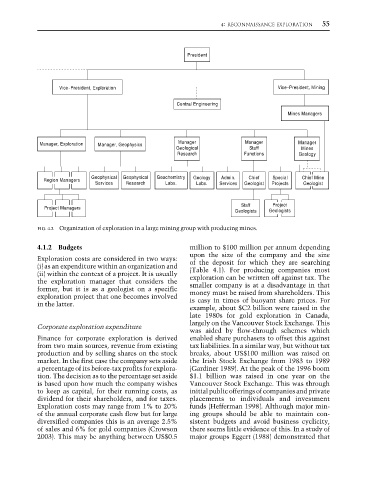

FIG. 4.2 Organization of exploration in a large mining group with producing mines.

4.1.2 Budgets million to $100 million per annum depending

upon the size of the company and the size

Exploration costs are considered in two ways: of the deposit for which they are searching

(i) as an expenditure within an organization and (Table 4.1). For producing companies most

(ii) within the context of a project. It is usually exploration can be written off against tax. The

the exploration manager that considers the smaller company is at a disadvantage in that

former, but it is as a geologist on a specific money must be raised from shareholders. This

exploration project that one becomes involved is easy in times of buoyant share prices. For

in the latter.

example, about $C2 billion were raised in the

late 1980s for gold exploration in Canada,

largely on the Vancouver Stock Exchange. This

Corporate exploration expenditure

was aided by flow-through schemes which

Finance for corporate exploration is derived enabled share purchasers to offset this against

from two main sources, revenue from existing tax liabilities. In a similar way, but without tax

production and by selling shares on the stock breaks, about US$100 million was raised on

market. In the first case the company sets aside the Irish Stock Exchange from 1983 to 1989

a percentage of its before-tax profits for explora- (Gardiner 1989). At the peak of the 1996 boom

tion. The decision as to the percentage set aside $1.1 billion was raised in one year on the

is based upon how much the company wishes Vancouver Stock Exchange. This was through

to keep as capital, for their running costs, as initial public offerings of companies and private

dividend for their shareholders, and for taxes. placements to individuals and investment

Exploration costs may range from 1% to 20% funds (Hefferman 1998). Although major min-

of the annual corporate cash flow but for large ing groups should be able to maintain con-

diversified companies this is an average 2.5% sistent budgets and avoid business cyclicity,

of sales and 6% for gold companies (Crowson there seems little evidence of this. In a study of

2003). This may be anything between US$0.5 major groups Eggert (1988) demonstrated that