Page 139 - Performance Leadership

P. 139

128 • Part II Operational and Analytical Dimensions

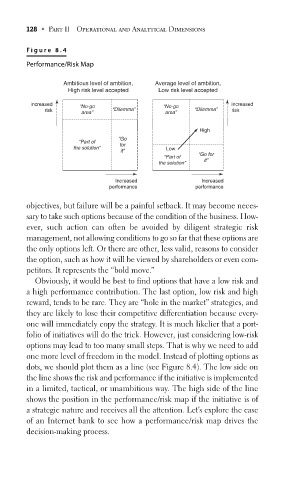

F igur e 8.4

Performance/Risk Map

Ambitious level of ambition, Average level of ambition,

High risk level accepted Low risk level accepted

increased “No-go “No-go increased

risk “Dilemma” “Dilemma” risk

area” area”

High

“Go

“Part of

for

the solution” Low

it”

“Part of “Go for

it”

the solution”

Increased Increased

performance performance

objectives, but failure will be a painful setback. It may become neces-

sary to take such options because of the condition of the business. How-

ever, such action can often be avoided by diligent strategic risk

management, not allowing conditions to go so far that these options are

the only options left. Or there are other, less valid, reasons to consider

the option, such as how it will be viewed by shareholders or even com-

petitors. It represents the “bold move.”

Obviously, it would be best to find options that have a low risk and

a high performance contribution. The last option, low risk and high

reward, tends to be rare. They are “hole in the market” strategies, and

they are likely to lose their competitive differentiation because every-

one will immediately copy the strategy. It is much likelier that a port-

folio of initiatives will do the trick. However, just considering low-risk

options may lead to too many small steps. That is why we need to add

one more level of freedom in the model. Instead of plotting options as

dots, we should plot them as a line (see Figure 8.4). The low side on

the line shows the risk and performance if the initiative is implemented

in a limited, tactical, or unambitious way. The high side of the line

shows the position in the performance/risk map if the initiative is of

a strategic nature and receives all the attention. Let’s explore the case

of an Internet bank to see how a performance/risk map drives the

decision-making process.