Page 33 - Performance Leadership

P. 33

22 • Part I A Review of Performance Management

it is important to understand the basics and how they relate to your

budgeting mechanism.

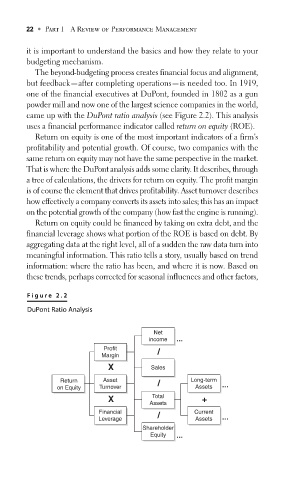

The beyond-budgeting process creates financial focus and alignment,

but feedback—after completing operations—is needed too. In 1919,

one of the financial executives at DuPont, founded in 1802 as a gun

powder mill and now one of the largest science companies in the world,

came up with the DuPont ratio analysis (see Figure 2.2). This analysis

uses a financial performance indicator called return on equity (ROE).

Return on equity is one of the most important indicators of a firm’s

profitability and potential growth. Of course, two companies with the

same return on equity may not have the same perspective in the market.

That is where the DuPont analysis adds some clarity. It describes, through

a tree of calculations, the drivers for return on equity. The profit margin

is of course the element that drives profitability. Asset turnover describes

how effectively a company converts its assets into sales; this has an impact

on the potential growth of the company (how fast the engine is running).

Return on equity could be financed by taking on extra debt, and the

financial leverage shows what portion of the ROE is based on debt. By

aggregating data at the right level, all of a sudden the raw data turn into

meaningful information. This ratio tells a story, usually based on trend

information: where the ratio has been, and where it is now. Based on

these trends, perhaps corrected for seasonal influences and other factors,

F igur e 2.2

DuPont Ratio Analysis

Net

income ...

Profit /

Margin

X Sales

Return Asset / Long-term

on Equity Turnover Assets ...

X Total +

Assets

Financial / Current

Leverage Assets ...

Shareholder

Equity ...