Page 145 -

P. 145

CHAPTER 4 • THE INTERNAL ASSESSMENT 111

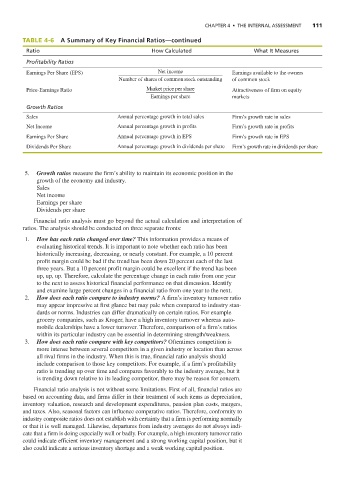

TABLE 4-6 A Summary of Key Financial Ratios—continued

Ratio How Calculated What It Measures

Profitability Ratios

Earnings Per Share (EPS) Net income Earnings available to the owners

Number of shares of common stock ooutstanding of common stock

Price-Earnings Ratio Market price per share Attractiveness of firm on equity

Earnings per share markets

Growth Ratios

Sales Annual percentage growth in total sales Firm’s growth rate in sales

Net Income Annual percentage growth in profits Firm’s growth rate in profits

Earnings Per Share Annual percentage growth in EPS Firm’s growth rate in EPS

Dividends Per Share Annual percentage growth in dividends per share Firm’s growth rate in dividends per share

5. Growth ratios measure the firm’s ability to maintain its economic position in the

growth of the economy and industry.

Sales

Net income

Earnings per share

Dividends per share

Financial ratio analysis must go beyond the actual calculation and interpretation of

ratios. The analysis should be conducted on three separate fronts:

1. How has each ratio changed over time? This information provides a means of

evaluating historical trends. It is important to note whether each ratio has been

historically increasing, decreasing, or nearly constant. For example, a 10 percent

profit margin could be bad if the trend has been down 20 percent each of the last

three years. But a 10 percent profit margin could be excellent if the trend has been

up, up, up. Therefore, calculate the percentage change in each ratio from one year

to the next to assess historical financial performance on that dimension. Identify

and examine large percent changes in a financial ratio from one year to the next.

2. How does each ratio compare to industry norms? A firm’s inventory turnover ratio

may appear impressive at first glance but may pale when compared to industry stan-

dards or norms. Industries can differ dramatically on certain ratios. For example

grocery companies, such as Kroger, have a high inventory turnover whereas auto-

mobile dealerships have a lower turnover. Therefore, comparison of a firm’s ratios

within its particular industry can be essential in determining strength/weakness.

3. How does each ratio compare with key competitors? Oftentimes competition is

more intense between several competitors in a given industry or location than across

all rival firms in the industry. When this is true, financial ratio analysis should

include comparison to those key competitors. For example, if a firm’s profitability

ratio is trending up over time and compares favorably to the industry average, but it

is trending down relative to its leading competitor, there may be reason for concern.

Financial ratio analysis is not without some limitations. First of all, financial ratios are

based on accounting data, and firms differ in their treatment of such items as depreciation,

inventory valuation, research and development expenditures, pension plan costs, mergers,

and taxes. Also, seasonal factors can influence comparative ratios. Therefore, conformity to

industry composite ratios does not establish with certainty that a firm is performing normally

or that it is well managed. Likewise, departures from industry averages do not always indi-

cate that a firm is doing especially well or badly. For example, a high inventory turnover ratio

could indicate efficient inventory management and a strong working capital position, but it

also could indicate a serious inventory shortage and a weak working capital position.