Page 143 -

P. 143

CHAPTER 4 • THE INTERNAL ASSESSMENT 109

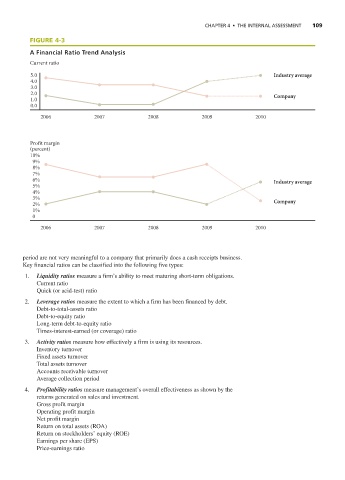

FIGURE 4-3

A Financial Ratio Trend Analysis

Current ratio

5.0 Industry average

4.0

3.0

2.0 Company

1.0

0.0

2006 2007 2008 2009 2010

Profit margin

(percent)

10%

9%

8%

7%

6% Industry average

5%

4%

3%

2% Company

1%

0

2006 2007 2008 2009 2010

period are not very meaningful to a company that primarily does a cash receipts business.

Key financial ratios can be classified into the following five types:

1. Liquidity ratios measure a firm’s ability to meet maturing short-term obligations.

Current ratio

Quick (or acid-test) ratio

2. Leverage ratios measure the extent to which a firm has been financed by debt.

Debt-to-total-assets ratio

Debt-to-equity ratio

Long-term debt-to-equity ratio

Times-interest-earned (or coverage) ratio

3. Activity ratios measure how effectively a firm is using its resources.

Inventory turnover

Fixed assets turnover

Total assets turnover

Accounts receivable turnover

Average collection period

4. Profitability ratios measure management’s overall effectiveness as shown by the

returns generated on sales and investment.

Gross profit margin

Operating profit margin

Net profit margin

Return on total assets (ROA)

Return on stockholders’ equity (ROE)

Earnings per share (EPS)

Price-earnings ratio