Page 186 -

P. 186

152 PART 2 • STRATEGY FORMULATION

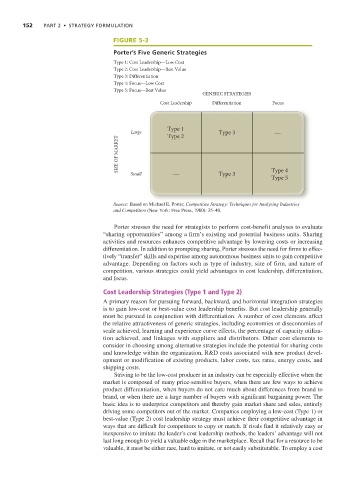

FIGURE 5-3

Porter’s Five Generic Strategies

Type 1: Cost Leadership—Low Cost

Type 2: Cost Leadership—Best Value

Type 3: Differentiation

Type 4: Focus—Low Cost

Type 5: Focus—Best Value

GENERIC STRATEGIES

Cost Leadership Differentiation Focus

Type 1

Large Type 2 Type 3 —

SIZE OF MARKET

Small — Type 3 Type 4

Type 5

Source: Based on Michael E. Porter, Competitive Strategy: Techniques for Analyzing Industries

and Competitors (New York: Free Press, 1980): 35–40.

Porter stresses the need for strategists to perform cost-benefit analyses to evaluate

“sharing opportunities” among a firm’s existing and potential business units. Sharing

activities and resources enhances competitive advantage by lowering costs or increasing

differentiation. In addition to prompting sharing, Porter stresses the need for firms to effec-

tively “transfer” skills and expertise among autonomous business units to gain competitive

advantage. Depending on factors such as type of industry, size of firm, and nature of

competition, various strategies could yield advantages in cost leadership, differentiation,

and focus.

Cost Leadership Strategies (Type 1 and Type 2)

A primary reason for pursuing forward, backward, and horizontal integration strategies

is to gain low-cost or best-value cost leadership benefits. But cost leadership generally

must be pursued in conjunction with differentiation. A number of cost elements affect

the relative attractiveness of generic strategies, including economies or diseconomies of

scale achieved, learning and experience curve effects, the percentage of capacity utiliza-

tion achieved, and linkages with suppliers and distributors. Other cost elements to

consider in choosing among alternative strategies include the potential for sharing costs

and knowledge within the organization, R&D costs associated with new product devel-

opment or modification of existing products, labor costs, tax rates, energy costs, and

shipping costs.

Striving to be the low-cost producer in an industry can be especially effective when the

market is composed of many price-sensitive buyers, when there are few ways to achieve

product differentiation, when buyers do not care much about differences from brand to

brand, or when there are a large number of buyers with significant bargaining power. The

basic idea is to underprice competitors and thereby gain market share and sales, entirely

driving some competitors out of the market. Companies employing a low-cost (Type 1) or

best-value (Type 2) cost leadership strategy must achieve their competitive advantage in

ways that are difficult for competitors to copy or match. If rivals find it relatively easy or

inexpensive to imitate the leader’s cost leadership methods, the leaders’ advantage will not

last long enough to yield a valuable edge in the marketplace. Recall that for a resource to be

valuable, it must be either rare, hard to imitate, or not easily substitutable. To employ a cost