Page 484 -

P. 484

80 JAMES L. HARBIN AND PATRICIA HUMPHREY

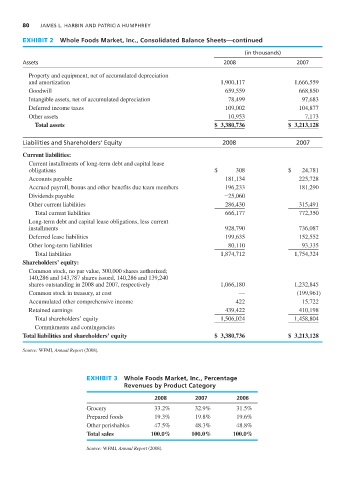

EXHIBIT 2 Whole Foods Market, Inc., Consolidated Balance Sheets—continued

(in thousands)

Assets 2008 2007

Property and equipment, net of accumulated depreciation

and amortization 1,900,117 1,666,559

Goodwill 659,559 668,850

Intangible assets, net of accumulated depreciation 78,499 97,683

Deferred income taxes 109,002 104,877

Other assets 10,953 7,173

Total assets $ 3,380,736 $ 3,213,128

Liabilities and Shareholders’ Equity 2008 2007

Current liabilities:

Current installments of long-term debt and capital lease

obligations $ 308 $ 24,781

Accounts payable 181,134 225,728

Accrued payroll, bonus and other benefits due team members 196,233 181,290

Dividends payable -25,060

Other current liabilities 286,430 315,491

Total current liabilities 666,177 772,350

Long-term debt and capital lease obligations, less current

installments 928,790 736,087

Deferred lease liabilities 199,635 152,552

Other long-term liabilities 80,110 93,335

Total liabilities 1,874,712 1,754,324

Shareholders’ equity:

Common stock, no par value, 300,000 shares authorized;

140,286 and 143,787 shares issued, 140,286 and 139,240

shares outstanding in 2008 and 2007, respectively 1,066,180 1,232,845

Common stock in treasury, at cost — (199,961)

Accumulated other comprehensive income 422 15,722

Retained earnings 439,422 410,198

Total shareholders’ equity 1,506,024 1,458,804

Commitments and contingencies

Total liabilities and shareholders’ equity $ 3,380,736 $ 3,213,128

Source: WFMI, Annual Report (2008).

EXHIBIT 3 Whole Foods Market, Inc., Percentage

Revenues by Product Category

2008 2007 2006

Grocery 33.2% 32.9% 31.5%

Prepared foods 19.3% 19.8% 19.6%

Other perishables 47.5% 48.3% 48.8%

Total sales 100.0% 100.0% 100.0%

Source: WFMI, Annual Report (2008).