Page 64 -

P. 64

30 PART 1 • OVERVIEW OF STRATEGIC MANAGEMENT

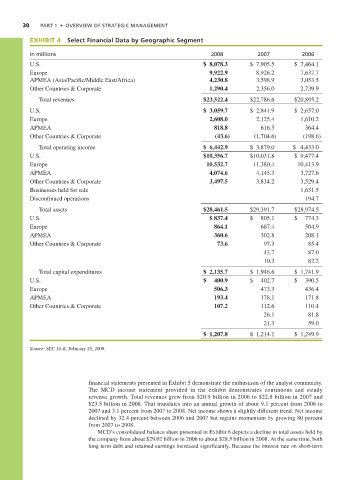

EXHIBIT 4 Select Financial Data by Geographic Segment

In millions 2008 2007 2006

U.S. $ 8,078.3 $ 7,905.5 $ 7,464.1

Europe 9,922.9 8,926.2 7,637.7

APMEA (Asia/Pacific/Middle East/Africa) 4,230.8 3,598.9 3,053.5

Other Countries & Corporate 1,290.4 2,356.0 2,739.9

Total revenues $23,522.4 $22,786.6 $20,895.2

U.S. $ 3,059.7 $ 2,841.9 $ 2,657.0

Europe 2,608.0 2,125.4 1,610.2

APMEA 818.8 616.3 364.4

Other Countries & Corporate (43.6) (1,704.6) (198.6)

Total operating income $ 6,442.9 $ 3,879.0 $ 4,433.0

U.S. $10,356.7 $10,031.8 $ 9,477.4

Europe 10,532.7 11,380.4 10,413.9

APMEA 4,074.6 4,145.3 3,727.6

Other Countries & Corporate 3,497.5 3,834.2 3,529.4

Businesses held for sale 1,631.5

Discontinued operations 194.7

Total assets $28,461.5 $29,391.7 $28,974.5

U.S. $ 837.4 $ 805.1 $ 774.3

Europe 864.1 687.4 504.9

APMEA 360.6 302.8 208.1

Other Countries & Corporate 73.6 97.3 85.4

43.7 87.0

10.3 82.2

Total capital expenditures $ 2,135.7 $ 1,946.6 $ 1,741.9

U.S. $ 400.9 $ 402.7 $ 390.5

Europe 506.3 473.3 436.4

APMEA 193.4 178.1 171.8

Other Countries & Corporate 107.2 112.6 110.4

26.1 81.8

21.3 59.0

$ 1,207.8 $ 1,214.1 $ 1,249.9

Source: SEC 10-K, February 25, 2009.

financial statements presented in Exhibit 5 demonstrate the enthusiasm of the analyst community.

The MCD income statement provided in the exhibit demonstrates continuous and steady

revenue growth. Total revenues grew from $20.9 billion in 2006 to $22.8 billion in 2007 and

$23.5 billion in 2008. That translates into an annual growth of about 9.1 percent from 2006 to

2007 and 3.1 percent from 2007 to 2008. Net income shows a slightly different trend. Net income

declined by 32.4 percent between 2006 and 2007 but regains momentum by growing 80 percent

from 2007 to 2008.

MCD’s consolidated balance sheet presented in Exhibit 6 depicts a decline in total assets held by

the company from about $29.02 billion in 2006 to about $28.5 billion in 2008. At the same time, both

long term debt and retained earnings increased significantly. Because the interest rate on short-term