Page 65 -

P. 65

THE COHESION CASE 31

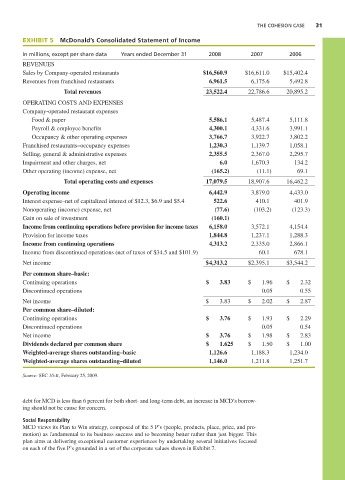

EXHIBIT 5 McDonald’s Consolidated Statement of Income

In millions, except per share data Years ended December 31 2008 2007 2006

REVENUES

Sales by Company-operated restaurants $16,560.9 $16,611.0 $15,402.4

Revenues from franchised restaurants 6,961.5 6,175.6 5,492.8

Total revenues 23,522.4 22,786.6 20,895.2

OPERATING COSTS AND EXPENSES

Company-operated restaurant expenses

Food & paper 5,586.1 5,487.4 5,111.8

Payroll & employee benefits 4,300.1 4,331.6 3,991.1

Occupancy & other operating expenses 3,766.7 3,922.7 3,802.2

Franchised restaurants–occupancy expenses 1,230.3 1,139.7 1,058.1

Selling, general & administrative expenses 2,355.5 2,367.0 2,295.7

Impairment and other charges, net 6.0 1,670.3 134.2

Other operating (income) expense, net (165.2) (11.1) 69.1

Total operating costs and expenses 17,079.5 18,907.6 16,462.2

Operating income 6,442.9 3,879.0 4,433.0

Interest expense–net of capitalized interest of $12.3, $6.9 and $5.4 522.6 410.1 401.9

Nonoperating (income) expense, net (77.6) (103.2) (123.3)

Gain on sale of investment (160.1)

Income from continuing operations before provision for income taxes 6,158.0 3,572.1 4,154.4

Provision for income taxes 1,844.8 1,237.1 1,288.3

Income from continuing operations 4,313.2 2,335.0 2,866.1

Income from discontinued operations (net of taxes of $34.5 and $101.9) 60.1 678.1

Net income $4,313.2 $2,395.1 $3,544.2

Per common share–basic:

Continuing operations $ 3.83 $ 1.96 $ 2.32

Discontinued operations 0.05 0.55

Net income $ 3.83 $ 2.02 $ 2.87

Per common share–diluted:

Continuing operations $ 3.76 $ 1.93 $ 2.29

Discontinued operations 0.05 0.54

Net income $ 3.76 $ 1.98 $ 2.83

Dividends declared per common share $ 1.625 $ 1.50 $ 1.00

Weighted-average shares outstanding–basic 1,126.6 1,188.3 1,234.0

Weighted-average shares outstanding–diluted 1,146.0 1,211.8 1,251.7

Source: SEC 10-K, February 25, 2009.

debt for MCD is less than 6 percent for both short- and long-term debt, an increase in MCD’s borrow-

ing should not be cause for concern.

Social Responsibility

MCD views its Plan to Win strategy, composed of the 5 P’s (people, products, place, price, and pro-

motion) as fundamental to its business success and to becoming better rather than just bigger. This

plan aims at delivering exceptional customer experiences by undertaking several initiatives focused

on each of the five P’s grounded in a set of the corporate values shown in Exhibit 7.