Page 108 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 108

94 The Complete Guide to Executive Compensation

of 1934. If it is deemed a security and a sale is involved, it will mean registration with

the SEC, proper disclosure to those covered, and concern that no fraud charge can be

directed to the “securities” management.

9. Benefits received are subject to FICA tax either when actually or constructively paid

(general rule), or earned and not subject to risk of forfeiture (special rule). The applica-

ble interpretation varies with the form and requirements of the plan and is beyond the

scope of this discussion. Suffice it to say that it may be a disadvantage (it is unlikely to

be an advantage) and needs to be carefully researched.

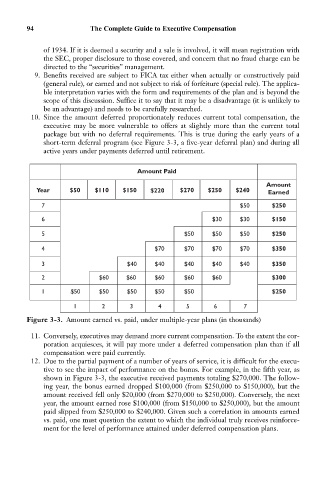

10. Since the amount deferred proportionately reduces current total compensation, the

executive may be more vulnerable to offers at slightly more than the current total

package but with no deferral requirements. This is true during the early years of a

short-term deferral program (see Figure 3-3, a five-year deferral plan) and during all

active years under payments deferred until retirement.

Amount Paid

Amount

Year $50 $110 $150 $220 $270 $250 $240 Earned

7 $50 $250

6 $30 $30 $150

5 $50 $50 $50 $250

4 $70 $70 $70 $70 $350

3 $40 $40 $40 $40 $40 $350

2 $60 $60 $60 $60 $60 $300

1 $50 $50 $50 $50 $50 $250

1 2 3 4 5 6 7

Figure 3-3. Amount earned vs. paid, under multiple-year plans (in thousands)

11. Conversely, executives may demand more current compensation. To the extent the cor-

poration acquiesces, it will pay more under a deferred compensation plan than if all

compensation were paid currently.

12. Due to the partial payment of a number of years of service, it is difficult for the execu-

tive to see the impact of performance on the bonus. For example, in the fifth year, as

shown in Figure 3-3, the executive received payments totaling $270,000. The follow-

ing year, the bonus earned dropped $100,000 (from $250,000 to $150,000), but the

amount received fell only $20,000 (from $270,000 to $250,000). Conversely, the next

year, the amount earned rose $100,000 (from $150,000 to $250,000), but the amount

paid slipped from $250,000 to $240,000. Given such a correlation in amounts earned

vs. paid, one must question the extent to which the individual truly receives reinforce-

ment for the level of performance attained under deferred compensation plans.