Page 146 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 146

132 The Complete Guide to Executive Compensation

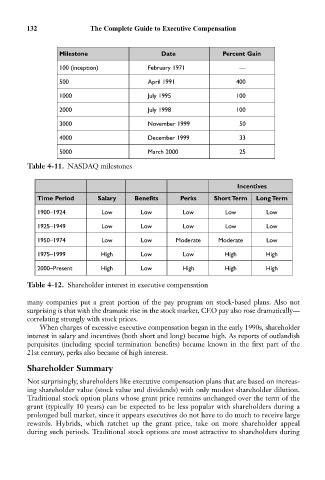

Milestone Date Percent Gain

100 (inception) February 1971 —

500 April 1991 400

1000 July 1995 100

2000 July 1998 100

3000 November 1999 50

4000 December 1999 33

5000 March 2000 25

Table 4-11. NASDAQ milestones

Incentives

Time Period Salary Benefits Perks Short Term Long Term

1900–1924 Low Low Low Low Low

1925–1949 Low Low Low Low Low

1950–1974 Low Low Moderate Moderate Low

1975–1999 High Low Low High High

2000–Present High Low High High High

Table 4-12. Shareholder interest in executive compensation

many companies put a great portion of the pay program on stock-based plans. Also not

surprising is that with the dramatic rise in the stock market, CEO pay also rose dramatically—

correlating strongly with stock prices.

When charges of excessive executive compensation began in the early 1990s, shareholder

interest in salary and incentives (both short and long) became high. As reports of outlandish

perquisites (including special termination benefits) became known in the first part of the

21st century, perks also became of high interest.

Shareholder Summary

Not surprisingly, shareholders like executive compensation plans that are based on increas-

ing shareholder value (stock value and dividends) with only modest shareholder dilution.

Traditional stock option plans whose grant price remains unchanged over the term of the

grant (typically 10 years) can be expected to be less popular with shareholders during a

prolonged bull market, since it appears executives do not have to do much to receive large

rewards. Hybrids, which ratchet up the grant price, take on more shareholder appeal

during such periods. Traditional stock options are most attractive to shareholders during