Page 147 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 147

Chapter 4. The Stakeholders 133

prolonged periods of modest growth. However, no one is very interested in stock options

of any type during prolonged bear markets, although one could argue that they would be

very useful if given shortly before the market reversed and the bulls resumed control.

Shareholders also like it when companies buy back their stock, because as it reduces the

number of shares in the marketplace, thereby, it is hoped, proportionately increasing the

stock price.

Conversely, shareholders do not like it when the company uses unissued stock for acqui-

sitions, because it increases the number of shares in the marketplace, thereby depressing the

stock price. For the same reason, they do not like insiders selling their shares of stock. And

they do not like plans that pay out based on internal financial goals (ignoring shareholder

value). Nor do they like restricted stock awards not tied to performance. Obviously, they do

not like repricing stock options at a lower price than originally granted. Nor do they like stock

option reloads (replacing exercised grants with new stock options). They are also not in favor

of omnibus plans, which permit multiple uses of stock without describing what will be used

when, nor of evergreen plans, which automatically replace stock used with new deposits to

the plan.

Some look to the following warning signs to indicate excessive executive pay: inter-

locking directors (especially on compensation committee), CEO friends on board and key

committees, and directors on more than several boards (thereby minimizing the time spent

on any one).

In determining whether shareholder approval is needed, check the requirements of the

stock exchange (in order to list shares), the state of incorporation, the IRS (for statutory

plans), or the SEC (in accord with the sale of securities).

THE CUSTOMERS

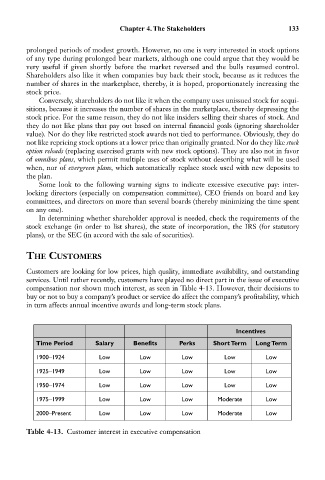

Customers are looking for low prices, high quality, immediate availability, and outstanding

services. Until rather recently, customers have played no direct part in the issue of executive

compensation nor shown much interest, as seen in Table 4-13. However, their decisions to

buy or not to buy a company’s product or service do affect the company’s profitability, which

in turn affects annual incentive awards and long-term stock plans.

Incentives

Time Period Salary Benefits Perks Short Term Long Term

1900–1924 Low Low Low Low Low

1925–1949 Low Low Low Low Low

1950–1974 Low Low Low Low Low

1975–1999 Low Low Low Moderate Low

2000–Present Low Low Low Moderate Low

Table 4-13. Customer interest in executive compensation