Page 150 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 150

136 The Complete Guide to Executive Compensation

Executive Judicial

Congress

(Administer and (Review

(Make Laws)

Interpret) Actions)

President

Treasury

SEC

IRS

(Financial

(Tax Rulings)

Disclosures)

FASB

(Accounting

Rules)

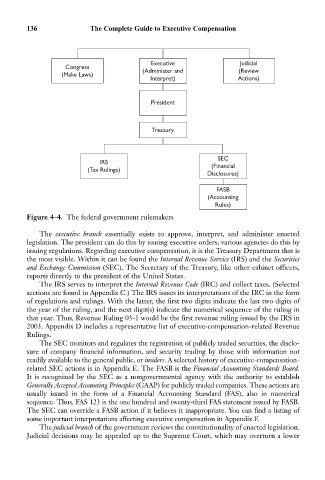

Figure 4-4. The federal government rulemakers

The executive branch essentially exists to approve, interpret, and administer enacted

legislation. The president can do this by issuing executive orders; various agencies do this by

issuing regulations. Regarding executive compensation, it is the Treasury Department that is

the most visible. Within it can be found the Internal Revenue Service (IRS) and the Securities

and Exchange Commission (SEC). The Secretary of the Treasury, like other cabinet officers,

reports directly to the president of the United States.

The IRS serves to interpret the Internal Revenue Code (IRC) and collect taxes. (Selected

sections are found in Appendix C.) The IRS issues its interpretations of the IRC in the form

of regulations and rulings. With the latter, the first two digits indicate the last two digits of

the year of the ruling, and the next digit(s) indicate the numerical sequence of the ruling in

that year. Thus, Revenue Ruling 03-1 would be the first revenue ruling issued by the IRS in

2003. Appendix D includes a representative list of executive-compensation-related Revenue

Rulings.

The SEC monitors and regulates the registration of publicly traded securities, the disclo-

sure of company financial information, and security trading by those with information not

readily available to the general public, or insiders. A selected history of executive-compensation-

related SEC actions is in Appendix E. The FASB is the Financial Accounting Standards Board.

It is recognized by the SEC as a nongovernmental agency with the authority to establish

Generally Accepted Accounting Principles (GAAP) for publicly traded companies. These actions are

usually issued in the form of a Financial Accounting Standard (FAS), also in numerical

sequence. Thus, FAS 123 is the one hundred and twenty-third FAS statement issued by FASB.

The SEC can override a FASB action if it believes it inappropriate. You can find a listing of

some important interpretations affecting executive compensation in Appendix F.

The judicial branch of the government reviews the constitutionality of enacted legislation.

Judicial decisions may be appealed up to the Supreme Court, which may overturn a lower