Page 172 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 172

158 The Complete Guide to Executive Compensation

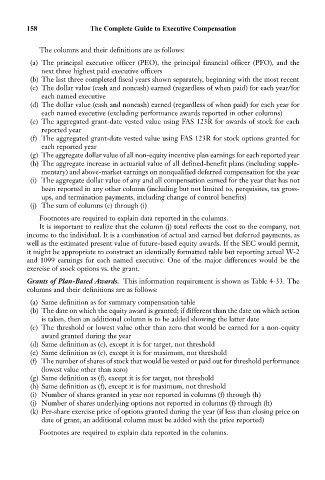

The columns and their definitions are as follows:

(a) The principal executive officer (PEO), the principal financial officer (PFO), and the

next three highest paid executive officers

(b) The last three completed fiscal years shown separately, beginning with the most recent

(c) The dollar value (cash and noncash) earned (regardless of when paid) for each year/for

each named executive

(d) The dollar value (cash and noncash) earned (regardless of when paid) for each year for

each named executive (excluding performance awards reported in other columns)

(e) The aggregated grant-date vested value using FAS 123R for awards of stock for each

reported year

(f) The aggregated grant-date vested value using FAS 123R for stock options granted for

each reported year

(g) The aggregate dollar value of all non-equity incentive plan earnings for each reported year

(h) The aggregate increase in actuarial value of all defined-benefit plans (including supple-

mentary) and above-market earnings on nonqualified deferred compensation for the year

(i) The aggregate dollar value of any and all compensation earned for the year that has not

been reported in any other column (including but not limited to, perquisites, tax gross-

ups, and termination payments, including change of control benefits)

(j) The sum of columns (c) through (i)

Footnotes are required to explain data reported in the columns.

It is important to realize that the column (j) total reflects the cost to the company, not

income to the individual. It is a combination of actual and earned but deferred payments, as

well as the estimated present value of future-based equity awards. If the SEC would permit,

it might be appropriate to construct an identically formatted table but reporting actual W-2

and 1099 earnings for each named executive. One of the major differences would be the

exercise of stock options vs. the grant.

Grants of Plan-Based Awards. This information requirement is shown as Table 4-33. The

columns and their definitions are as follows:

(a) Same definition as for summary compensation table

(b) The date on which the equity award is granted; if different than the date on which action

is taken, then an additional column is to be added showing the latter date

(c) The threshold or lowest value other than zero that would be earned for a non-equity

award granted during the year

(d) Same definition as (c), except it is for target, not threshold

(e) Same definition as (c), except it is for maximum, not threshold

(f) The number of shares of stock that would be vested or paid out for threshold performance

(lowest value other than zero)

(g) Same definition as (f), except it is for target, not threshold

(h) Same definition as (f), except it is for maximum, not threshold

(i) Number of shares granted in year not reported in columns (f) through (h)

(j) Number of shares underlying options not reported in columns (f) through (h)

(k) Per-share exercise price of options granted during the year (if less than closing price on

date of grant, an additional column must be added with the price reported)

Footnotes are required to explain data reported in the columns.