Page 177 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 177

Chapter 4. The Stakeholders 163

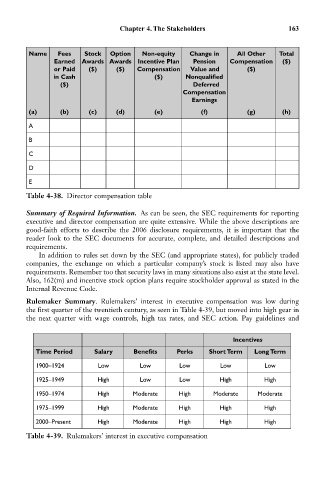

Name Fees Stock Option Non-equity Change in All Other Total

Earned Awards Awards Incentive Plan Pension Compensation ($)

or Paid ($) ($) Compensation Value and ($)

in Cash ($) Nonqualified

($) Deferred

Compensation

Earnings

(a) (b) (c) (d) (e) (f) (g) (h)

A

B

C

D

E

Table 4-38. Director compensation table

Summary of Required Information. As can be seen, the SEC requirements for reporting

executive and director compensation are quite extensive. While the above descriptions are

good-faith efforts to describe the 2006 disclosure requirements, it is important that the

reader look to the SEC documents for accurate, complete, and detailed descriptions and

requirements.

In addition to rules set down by the SEC (and appropriate states), for publicly traded

companies, the exchange on which a particular company’s stock is listed may also have

requirements. Remember too that security laws in many situations also exist at the state level.

Also, 162(m) and incentive stock option plans require stockholder approval as stated in the

Internal Revenue Code.

Rulemaker Summary. Rulemakers’ interest in executive compensation was low during

the first quarter of the twentieth century, as seen in Table 4-39, but moved into high gear in

the next quarter with wage controls, high tax rates, and SEC action. Pay guidelines and

Incentives

Time Period Salary Benefits Perks Short Term Long Term

1900–1924 Low Low Low Low Low

1925–1949 High Low Low High High

1950–1974 High Moderate High Moderate Moderate

1975–1999 High Moderate High High High

2000–Present High Moderate High High High

Table 4-39. Rulemakers’ interest in executive compensation