Page 469 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 469

Chapter 8. Long-Term Incentives 455

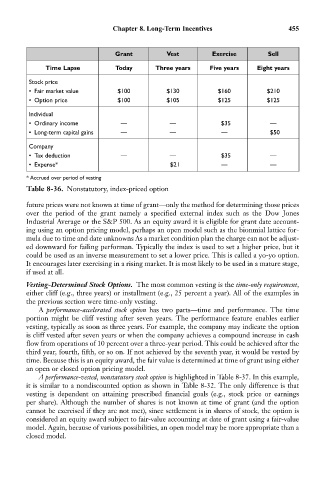

Grant Vest Exercise Sell

Time Lapse Today Three years Five years Eight years

Stock price

• Fair market value $100 $130 $160 $210

• Option price $100 $105 $125 $125

Individual

• Ordinary income — — $35 —

• Long-term capital gains — — — $50

Company

• Tax deduction — — $35 —

• Expense* $21 — —

* Accrued over period of vesting

Table 8-36. Nonstatutory, index-priced option

future prices were not known at time of grant—only the method for determining those prices

over the period of the grant namely a specified external index such as the Dow Jones

Industrial Average or the S&P 500. As an equity award it is eligible for grant date account-

ing using an option pricing model, perhaps an open model such as the bionmial lattice for-

mula due to time and date unknowns As a market condition plan the charge can not be adjust-

ed downward for failing performan. Typically the index is used to set a higher price, but it

could be used as an inverse measurement to set a lower price. This is called a yo-yo option.

It encourages later exercising in a rising market. It is most likely to be used in a mature stage,

if used at all.

Vesting-Determined Stock Options. The most common vesting is the time-only requirement,

either cliff (e.g., three years) or installment (e.g., 25 percent a year). All of the examples in

the previous section were time-only vesting.

A performance-accelerated stock option has two parts—time and performance. The time

portion might be cliff vesting after seven years. The performance feature enables earlier

vesting, typically as soon as three years. For example, the company may indicate the option

is cliff vested after seven years or when the company achieves a compound increase in cash

flow from operations of 10 percent over a three-year period. This could be achieved after the

third year, fourth, fifth, or so on. If not achieved by the seventh year, it would be vested by

time. Because this is an equity award, the fair value is determined at time of grant using either

an open or closed option pricing model.

A performance-vested, nonstatutory stock option is highlighted in Table 8-37. In this example,

it is similar to a nondiscounted option as shown in Table 8-32. The only difference is that

vesting is dependent on attaining prescribed financial goals (e.g., stock price or earnings

per share). Although the number of shares is not known at time of grant (and the option

cannot be exercised if they are not met), since settlement is in shares of stock, the option is

considered an equity award subject to fair-value accounting at date of grant using a fair-value

model. Again, because of various possibilities, an open model may be more appropriate than a

closed model.