Page 522 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 522

508 The Complete Guide to Executive Compensation

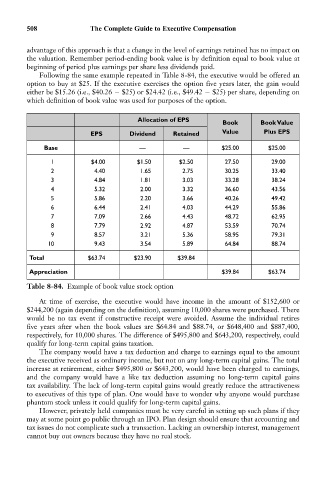

advantage of this approach is that a change in the level of earnings retained has no impact on

the valuation. Remember period-ending book value is by definition equal to book value at

beginning of period plus earnings per share less dividends paid.

Following the same example repeated in Table 8-84, the executive would be offered an

option to buy at $25. If the executive exercises the option five years later, the gain would

either be $15.26 (i.e., $40.26 $25) or $24.42 (i.e., $49.42 $25) per share, depending on

which definition of book value was used for purposes of the option.

Allocation of EPS

Book Book Value

EPS Dividend Retained Value Plus EPS

Base — — $25.00 $25.00

1 $4.00 $1.50 $2.50 27.50 29.00

2 4.40 1.65 2.75 30.25 33.40

3 4.84 1.81 3.03 33.28 38.24

4 5.32 2.00 3.32 36.60 43.56

5 5.86 2.20 3.66 40.26 49.42

6 6.44 2.41 4.03 44.29 55.86

7 7.09 2.66 4.43 48.72 62.95

8 7.79 2.92 4.87 53.59 70.74

9 8.57 3.21 5.36 58.95 79.31

10 9.43 3.54 5.89 64.84 88.74

Total $63.74 $23.90 $39.84

Appreciation $39.84 $63.74

Table 8-84. Example of book value stock option

At time of exercise, the executive would have income in the amount of $152,600 or

$244,200 (again depending on the definition), assuming 10,000 shares were purchased. There

would be no tax event if constructive receipt were avoided. Assume the individual retires

five years after when the book values are $64.84 and $88.74, or $648,400 and $887,400,

respectively, for 10,000 shares. The difference of $495,800 and $643,200, respectively, could

qualify for long-term capital gains taxation.

The company would have a tax deduction and charge to earnings equal to the amount

the executive received as ordinary income, but not on any long-term capital gains. The total

increase at retirement, either $495,800 or $643,200, would have been charged to earnings,

and the company would have a like tax deduction assuming no long-term capital gains

tax availability. The lack of long-term capital gains would greatly reduce the attractiveness

to executives of this type of plan. One would have to wonder why anyone would purchase

phantom stock unless it could qualify for long-term capital gains.

However, privately held companies must be very careful in setting up such plans if they

may at some point go public through an IPO. Plan design should ensure that accounting and

tax issues do not complicate such a transaction. Lacking an ownership interest, management

cannot buy out owners because they have no real stock.