Page 547 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 547

Chapter 9. Design and Communication Considerations 533

One would expect that an increase in risk would result in an increase in the use of

incentives. Certainly, this is desirable from the shareholders’ viewpoint. To the extent this is

not true, it might suggest management has had a very strong say in plan design. After all, they

would like high pay associated with low risk.

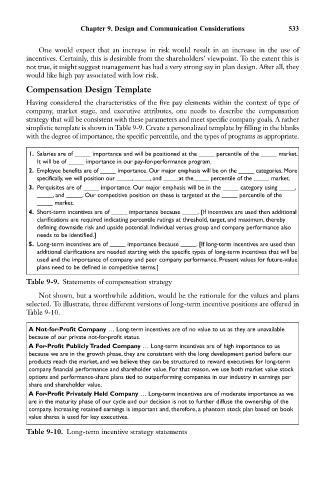

Compensation Design Template

Having considered the characteristics of the five pay elements within the context of type of

company, market stage, and executive attributes, one needs to describe the compensation

strategy that will be consistent with these parameters and meet specific company goals. A rather

simplistic template is shown in Table 9-9. Create a personalized template by filling in the blanks

with the degree of importance, the specific percentile, and the types of programs as appropriate.

1. Salaries are of _____ importance and will be positioned at the _____ percentile of the _____ market.

It will be of _____ importance in our pay-for-performance program.

2. Employee benefits are of _____ importance. Our major emphasis will be on the _____ categories. More

specifically, we will position our _____, _____, and _____at the_____ percentile of the _____ market.

3. Perquisites are of _____ importance. Our major emphasis will be in the _____ category using _____,

_____, and _____. Our competitive position on these is targeted at the _____ percentile of the

_____ market.

4. Short-term incentives are of _____ importance because _____. [If incentives are used then additional

clarifications are required indicating percentile ratings at threshold, target, and maximum, thereby

defining downside risk and upside potential. Individual versus group and company performance also

needs to be identified.]

5. Long-term incentives are of _____ importance because _____. [If long-term incentives are used then

additional clarifications are needed starting with the specific types of long-term incentives that will be

used and the importance of company and peer company performance. Present values for future-value

plans need to be defined in competitive terms.]

Table 9-9. Statements of compensation strategy

Not shown, but a worthwhile addition, would be the rationale for the values and plans

selected. To illustrate, three different versions of long-term incentive positions are offered in

Table 9-10.

A Not-for-Profit Company … Long-term incentives are of no value to us as they are unavailable

because of our private not-for-profit status.

A For-Profit Publicly Traded Company … Long-term incentives are of high importance to us

because we are in the growth phase, they are consistent with the long development period before our

products reach the market, and we believe they can be structured to reward executives for long-term

company financial performance and shareholder value. For that reason, we use both market value stock

options and performance-share plans tied to outperforming companies in our industry in earnings per

share and shareholder value.

A For-Profit Privately Held Company … Long-term incentives are of moderate importance as we

are in the maturity phase of our cycle and our decision is not to further diffuse the ownership of the

company. Increasing retained earnings is important and, therefore, a phantom stock plan based on book

value shares is used for key executives.

Table 9-10. Long-term incentive strategy statements