Page 550 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 550

536 The Complete Guide to Executive Compensation

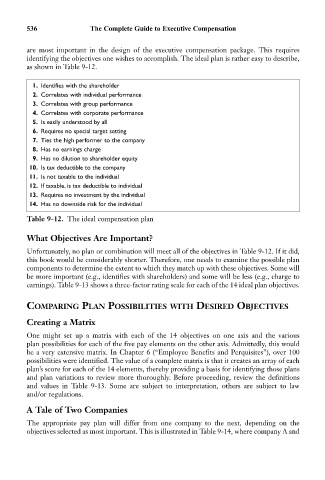

are most important in the design of the executive compensation package. This requires

identifying the objectives one wishes to accomplish. The ideal plan is rather easy to describe,

as shown in Table 9-12.

1. Identifies with the shareholder

2. Correlates with individual performance

3. Correlates with group performance

4. Correlates with corporate performance

5. Is easily understood by all

6. Requires no special target setting

7. Ties the high performer to the company

8. Has no earnings charge

9. Has no dilution to shareholder equity

10. Is tax deductible to the company

11. Is not taxable to the individual

12. If taxable, is tax deductible to individual

13. Requires no investment by the individual

14. Has no downside risk for the individual

Table 9-12. The ideal compensation plan

What Objectives Are Important?

Unfortunately, no plan or combination will meet all of the objectives in Table 9-12. If it did,

this book would be considerably shorter. Therefore, one needs to examine the possible plan

components to determine the extent to which they match up with these objectives. Some will

be more important (e.g., identifies with shareholders) and some will be less (e.g., charge to

earnings). Table 9-13 shows a three-factor rating scale for each of the 14 ideal plan objectives.

COMPARING PLAN POSSIBILITIES WITH DESIRED OBJECTIVES

Creating a Matrix

One might set up a matrix with each of the 14 objectives on one axis and the various

plan possibilities for each of the five pay elements on the other axis. Admittedly, this would

be a very extensive matrix. In Chapter 6 (“Employee Benefits and Perquisites”), over 100

possibilities were identified. The value of a complete matrix is that it creates an array of each

plan’s score for each of the 14 elements, thereby providing a basis for identifying those plans

and plan variations to review more thoroughly. Before proceeding, review the definitions

and values in Table 9-13. Some are subject to interpretation, others are subject to law

and/or regulations.

A Tale of Two Companies

The appropriate pay plan will differ from one company to the next, depending on the

objectives selected as most important. This is illustrated in Table 9-14, where company A and